From a double-digit appreciation of housing values and historically low mortgage interest rates to crazy market inflation and skyrocketing interest rates, the real estate market has been experiencing a wild ride for the last couple of years. The next part of this crazy ride seems to be a potential recession of the US economy that’s just over the horizon, which is causing many real estate investors, potential buyers, and property owners to question how it will affect the real estate market.

At this point, it’s a guessing game whether a recession is coming or not because many experts are still split over the likelihood of it happening any time soon. There has also been a lot of speculation and anticipation of a possible housing market crash. This anticipation has property owners worried as excited buyers wait for potential deals at bargain prices to hit the market.

In this article, we’re going to provide insight into pressing questions about the real estate market:

- Why are so many expecting a real estate market crash?

- Will record-high inflation cause housing prices to drop?

- Will an upcoming recession cause the real estate market to crash?

- Is it still a good time to buy real estate?

- Is it the wrong time to sell my property?

- Why You Shouldn’t Sell Your Property in 2022

Why are so many expecting a real estate market crash?

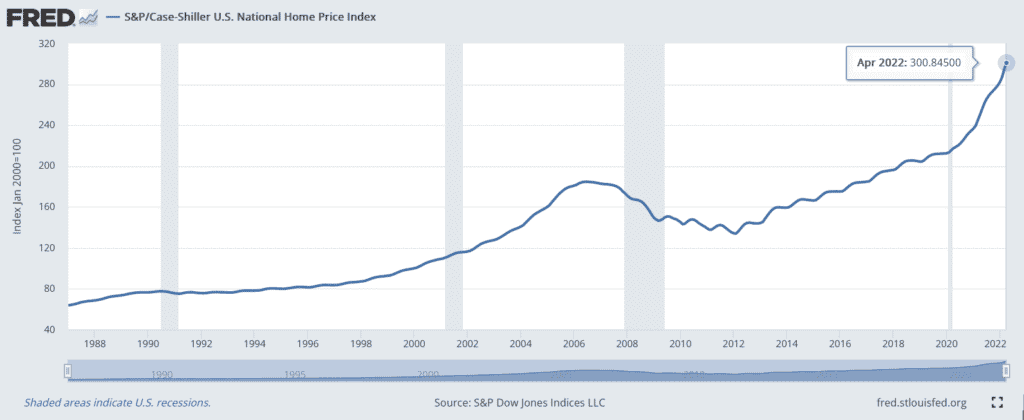

Home Value Appreciation

The first reason has to do with appreciation of real estate properties. Ever since the 2008 market crash, home values in the US have experienced a steady appreciation in value which heavily accelerated during the 2020 COVID-19 recession. For many seasoned investors and analysts, historical trends and previous cycles have shown that a significant rise in home values is typically followed by a real estate market correction. The puzzle for everyone involved has always been about how much longer the appreciation of home values could continue. Among them are a fair amount of home buyers and investors that have been anticipating and hoping for a market crash in order to finally be able to take advantage of a massive drop in property values.

Rising Mortgage Interest Rates

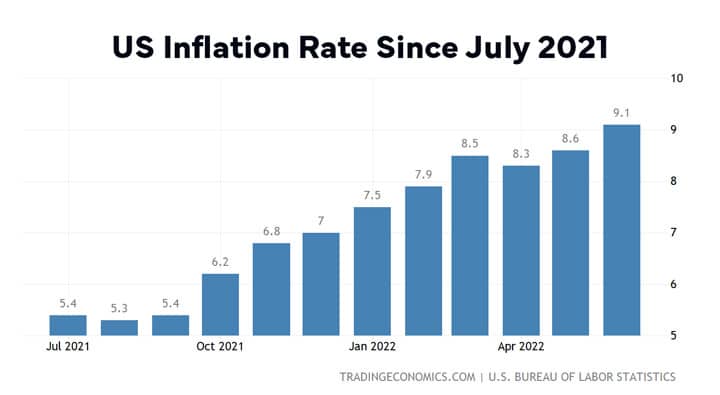

Another reason why many are expecting a real estate market crash is due to record-high inflation and rising mortgage interest rates. Ever since October 2021, the rate of inflation for consumer prices has been rising faster than the average annual inflation rate of 3.8% per year.

The reasons the US is in this economic situation are complicated but can be boiled down simply: There is too much demand and not enough supply. While there is no unanimous agreement among economists on the exact cause of this inflation surge, some of the main culprits are the global supply shortage that resulted during the COVID-19 pandemic in 2020, the excessive US Government spending on COVID-19 relief and economic stimulus programs, and the rise of energy prices as a direct result of the Russian invasion of Ukraine.

The lack of available products and services due to global supply chain issues coupled with the demand of American consumers with stimulus money and equity to spend have caused significant increases in consumer prices, which led directly to the inflation we are all experiencing today. The Russian invasion of Ukraine in February 2022 and the subsequent economic sanctions imposed by various countries also played a big role in exacerbating the problem.

Since Russia is the world’s largest exporter of commodities such as grains and natural gas, and among the world’s largest suppliers of oil and metals, the imposed sanctions threatened global supply chains and caused prices to surge globally due to increasing consumer demand after the COVID-19 pandemic. This resulted in gasoline prices increasing in the US, which further caused the cost of manufacturing and distribution of goods to increase. The more consumer prices went up, the more the inflation rate increased to record-high levels not seen since four decades ago.

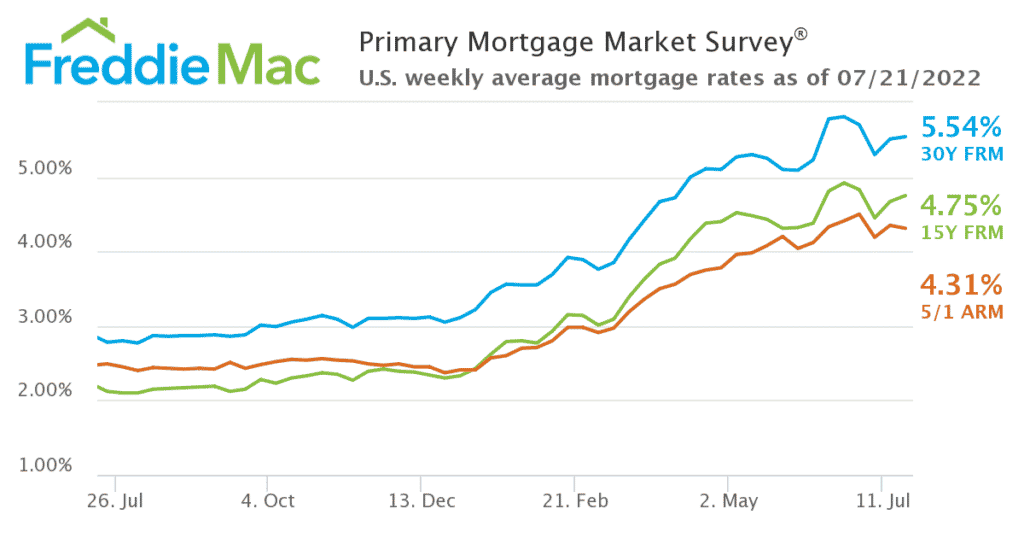

In order to combat inflation, the Federal Reserve has been raising interest rates throughout 2022. By raising interest rates, the Federal Reserve hopes to tackle high prices and reduce demand by making it more expensive to borrow money. When interest rates go up, mortgages become more expensive as the interest rate on mortgages also goes up. This makes it more costly for potential buyers and investors to purchase a property.

Since property values have been steadily appreciating over the last decade and rising interest rates have alienated potential home buyers, the demand for properties has cooled off. The general idea in most people’s heads is that if demand decreases, so will property values. Combined with hopeful buyers anticipating a long-due market correction, this is why many people have been expecting the real estate market to crash.

Now the million-dollar question is: Will a possible recession cause a California real estate market crash in 2022?

Will record-high inflation cause housing prices to drop?

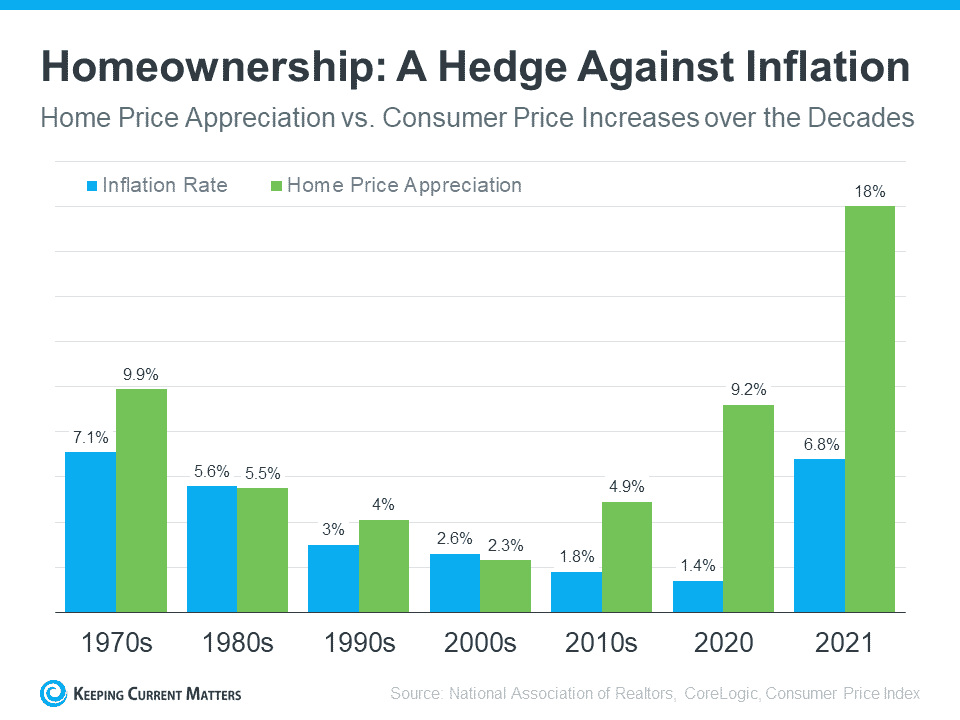

The short answer is: Absolutely not. Despite record-high inflation, real estate investors and homeowners should not be worried about it causing a drop in housing prices because real estate has always been the best hedge against inflation.

The one thing that generally keeps up with inflation, and even outperforms it, is real estate. Home appreciation has always followed the rate of inflation over the decades and has even surpassed it many times. The biggest example of this happened in 2021, when inflation was at an average of 6.8% and home values appreciated by a whopping 18% that same year.

If we trace this pattern and historical trends throughout the last five decades, then we can conclude that no matter how high inflation reaches in the United States, it will not cause property values to drop any time soon.

Will a possible recession cause a real estate market crash in 2022?

Since record-high inflation won’t be the cause of a possible real estate market crash, what about a potential recession in 2022? It’s highly unlikely and here are a few reasons why.

Reason #1: A Recession Doesn’t Equal a Housing Market Crash

The main problem with people involved with real estate is that most of them don’t even know what a recession means, yet the word makes them believe that property values are going to come crashing down once it happens. The real confusion happens when the words recession and crash get mixed up with each other. A recession means that the entire US economy and all industries, not just the real estate industry, are experiencing a slowdown, as indicated by two quarters of negative GDP growth. A crash simply refers to a crash of real estate housing prices.

While the possibility of an economic recession in 2022 is still 50/50 and heavily debated, a recession does not ultimately mean that the real estate market is going to experience a crash.

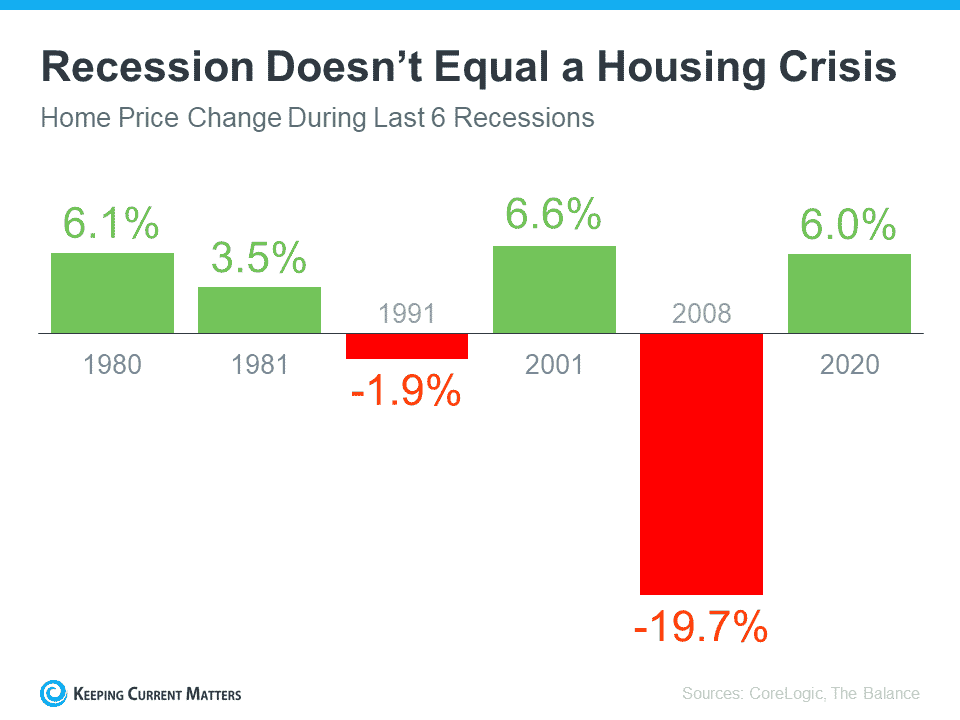

In most recessions, real estate property values tend to go up. During the last six economic recessions, home property values went up four times except for the recessions in 1991 and 2008. In the economic recession that happened in 1991, housing prices only decreased by 1.9% nationwide. In terms of finding a good deal, a discount of 1.9% does not seem that significant for any buyer. It won’t even be enough of a price decrease to worry any property owner.

The only outlier in historical trends appears to be the Great Recession of 2008, in which housing prices plummeted by 19.7%. This extreme drop in property values was mainly caused by bad mortgage lending practices of the subprime mortgage market and overbuilt houses. Subprime loans were offered to people with low income or bad credit who wouldn’t normally qualify for conventional loans.

There are a few reasons why the 2008 market crash will not likely happen ever again:

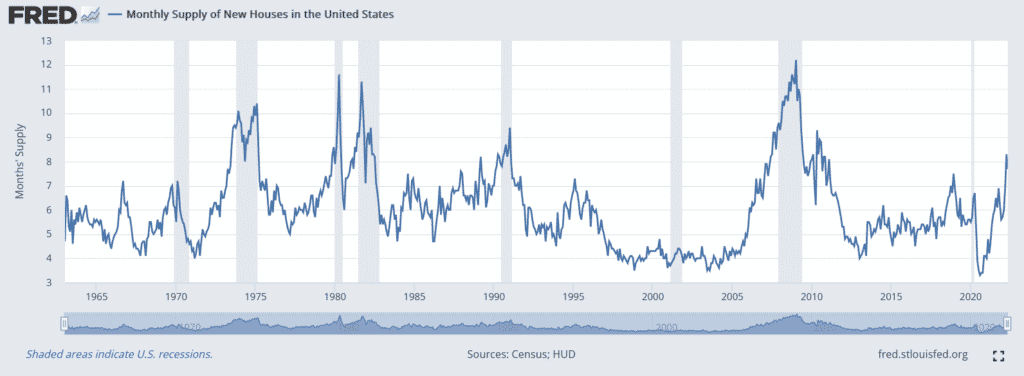

1. Housing construction has decreased significantly compared to the years prior to 2008.

Over the last decade, instead of overbuilding, housing developers have become smarter and did the exact opposite. Home builders have dropped their pace a few notches after the last crash, and they never fully ramped up to pre-2007 levels of construction.

While they are still building as much as they can, a repeat of the overbuilding of 15 years ago looks unlikely. They still haven’t been able to match the housing demand in California since they haven’t been able to develop a sufficient supply of homes due to labor shortages and increased material costs caused by the COVID-19 pandemic.

You may have heard that lumber prices rose by 300% last year as demand outstrips supply. Therefore, framing costs to build a house are up by at least 200% as lumber accounts for 70% of framing costs. To build a new 2,000 sqft house, framing costs might be up $70,000 – $100,000.

2. Mortgage lending standards remain strict.

The Dodd-Frank Wall Street Reform and Consumer Protection Act and the Emergency Economic Stabilization Act, which created the Troubled Asset Relief Program helped solve the financial crisis of 2008. Along with that program, the creation of the Consumer Financial Protection Bureau and Financial Stability Oversight Council helped monitor financial institutions and protect consumers.

Most importantly, the mortgage industry has shifted dramatically since the market crash of 2008. Lenders have strengthened their mortgage lending processes, including improved underwriting and collateral assessment. Additionally, tighter lending regulations have formed guardrails for mortgage lending standards that did not exist 10 years ago. Overall, despite being introduced to historically-low interest rates in 2020, the mortgage system today is much safer due to strict changes in credit eligibility and lending standards following 2008.

Even if the US economy experiences a recession in 2022, it is highly unlikely that the real estate market will experience a crash of property values.

Reason #2: Nationwide Housing Inventory is Still Near Record Lows

The supply of homes available in the United States, and especially here in California, is still struggling to meet consumer demand despite the market cooling down and housing inventory slowly starting to recover.

The lack of inventory explains why buyers still have little choice but to bid up home prices. This also indicates that the supply-and-demand equation simply won’t allow a property value crash in the near future. Since California has been experiencing a housing shortage for the last five decades that will most likely continue for more decades to come, the ongoing demand for housing in California will still be providing upwards pressure on housing values for many more years.

“As rates remain on the rise, the sense of urgency to buy is keeping the market highly competitive, especially since housing inventory continues to stay well below pre-pandemic levels,” said California Association of Realtors President Otto Catrina. “While we will likely see more listings come on to the market as we move further into the home-buying season, the housing shortage issue will likely persist throughout the rest of the year in major metropolitan areas, such as the Bay Area and the Southern California region.”

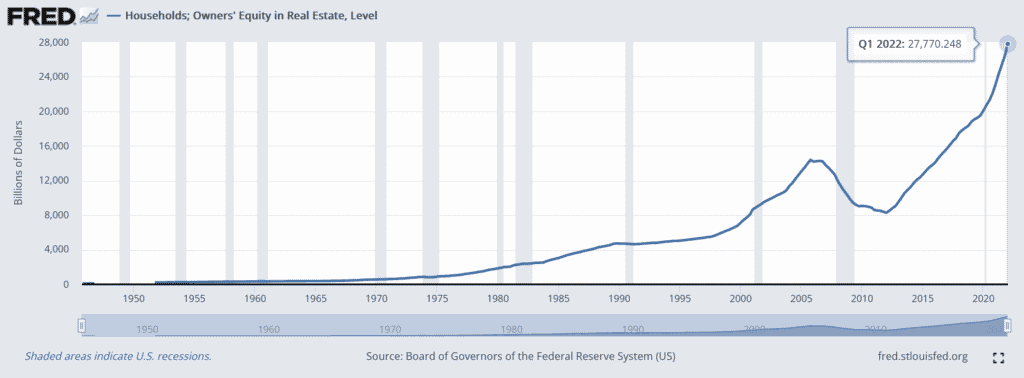

Reason #3: Foreclosure Activity Remains Low

In the years following the housing crash of 2008, millions of foreclosures flooded the housing market, which caused home prices to drop significantly. That’s not the case now in 2022 ever since foreclosures fell to a record low in 2020 despite a recession and global pandemic.

This is because most homeowners now have a comfortable cushion of equity in their properties. With so much homeowner’s equity available, there won’t be a housing market crash any time soon.

In summary, will there be a real estate market crash in 2022? No, but it’s most likely going to be a much-needed market correction. A severe, unusual, and unforeseen economic crisis would be required to cause a real estate market catastrophe in 2022. If there’s one thing we’ve learned from housing patterns and historical trends over the last year, it’s that not even a global pandemic stopped real estate investors and buyers from purchasing properties. They are still buying houses nationwide, so much so that inventory levels in many states have reached all-time lows.

Is it still a good time to buy real estate in California?

If you’ve been thinking of buying a home or multifamily property and you’ve been waiting for an opportunity to take advantage of the next “market crash” or correction, then you’ll be waiting for a lot longer.

According to Juan Huizar, a local real estate investor and broker from Long Beach, California, “part of the problem is that people are simply waiting too long,” and his question to every who is waiting for a great deal is: “How much longer are you gonna wait?”

The reality is that properties in California have been experiencing 14 years of massive appreciation since the last market crash of 2008. When you disregard the recession of 2008 as an outlier, you’ll soon realize that historical trends show a pattern of constant appreciation for home values in the state.

Waiting for a crash in property values, which we’ve determined is not going to happen soon, is only preventing you from building your wealth through appreciation of real estate values.

Even if an economic recession happens in 2022, it will most likely just result in a much-needed correction in real estate values. Mark Zandi, the chief economist at Moody’s Analytics, said that if interest rates don’t jump over 6% for an extended period and the economy avoids a recession, Southern California home prices should be largely flat over the next few years. “But if interest rates rise to around 6.25% or 6.5% and hold there,” Zandi said, “Southern California prices would probably fall around 5%.”

For the buyer who’s been waiting almost 14 years for a drop in housing prices: 5% doesn’t seem much of a discount compared to the average year-over-year appreciation of 5.5% that you could have experienced within those 14 years had you purchased a property.

In short, it’s always a good time to buy a property in California because of the constant value appreciation that properties experience over time. Waiting for a potential 5% drop in property values isn’t worth the risk of losing out on the wealth you could’ve built.

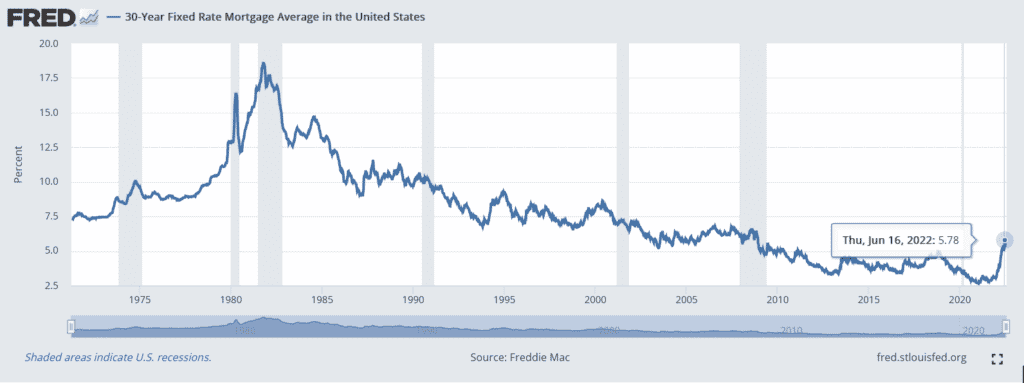

Mortgage Interest Rates are Still Historically Low

Buying a property as mortgage interest rates are rising is nothing to be afraid of. Based on historical trends, a mortgage rate between 5% and 6% is still remarkably low.

The annual average for 30-year fixed mortgage rates has not reached 5% since 2009. At the start of the Great Recession in 2006, the average mortgage rate was 6.41%. Ten years earlier, in 1996, the average mortgage rate was 7.81%, and 10 years earlier than that in 1986, the average mortgage rate was 10.19%.

Interest rates remaining near historic lows is still a good indicator for buyers, and today’s market still offers some of the cheapest debt a home buyer will be able to attain in the market.

Curious about how much you can qualify for a mortgage in California? Our Sage Trust Mortgage division might be able to help you!

Most important of all is finding the right property for you. It all depends on receiving the right advice from a trusted real estate broker. If you’re looking to purchase properties anywhere in the United States, our team is connected to trusted nationwide affiliates that can help!

Is it the wrong time to sell my property?

If you already own a home or an investment property and you’re thinking of either getting out of property management, moving out of state, or simply retiring, then you might be considering whether this is a good time to sell your property in 2022. Yet you’re still probably wondering how a possible recession will affect you when you decide to sell.

In case you decide to put your property on the market, and a recession happens, these are the only things that you need to consider:

1. Your property is potentially going to sit in the market for a bit longer.

With more inventory expected to hit the market as the year goes on, you’re going to face more competition from other properties. Since rising interest rates and buyer fatigue have lessened the number of available buyers in the market, your property may not sell as fast as during the last few years.

2. You might experience a possible reduction in price.

We’ve already established that even if a recession occurs, housing prices in California will remain flat. Even then, there is a possibility of a 5% price reduction or correction, which may or may not happen. If it happens, 5% is still not enough to shake up any seller who wants to either get out of property management, move out of state, or simply retire.

According to Juan Huizar, there will most likely not be a massive price reduction in the 2-to-20 unit range of multifamily properties. However, he expects a larger price drop in the real estate syndication level, when a group of investors pool together their capital to jointly purchase hundreds and thousands of units.

Right now, we are still at the peak of the market, and the potential price reduction many are expecting still has not happened yet. Therefore, right now is still a good time to sell your property.

3. Demand for real estate is still high in California.

Many sellers and clients we’ve worked with at Sage Real Estate are afraid that investors are pulling back from the market. This could not be further from the truth because there’s still a line of people that want to get into owning real estate in California, and higher interest rates are still not keeping these investors away.

Why You Should Sell Your Property in 2022

1. You’ve built up equity, and your money is “getting lazy”.

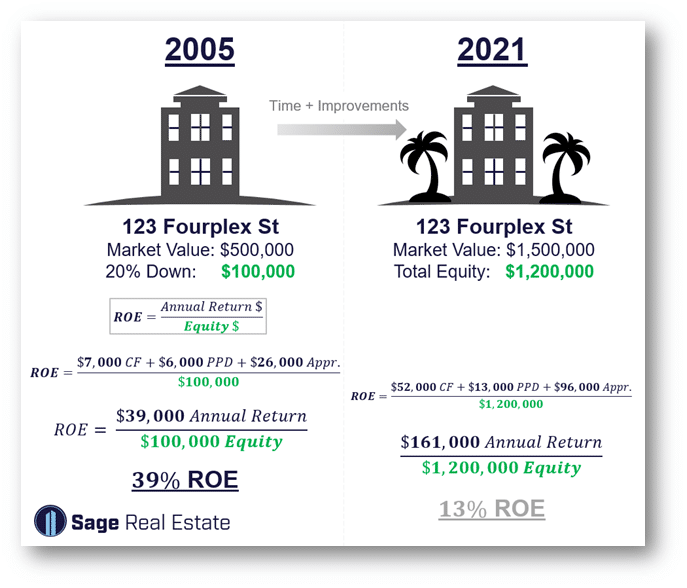

There’s a little-known formula in real estate finance that turns small-time investors into millionaires. It’s counter-intuitive to the old adage that “cash flow is king,” and if you apply it and use it correctly, it will transform your financial future. This is called Return on Equity, which measures how your money gets lazy over time. Learn more about it here.

The total equity you have in a property grows from one year to the next, meaning you get more and more of your wealth tied up in a property, but the property isn’t GIVING you a whole lot more in return. Calculating your property’s return on equity will tell you when it’s time to sell and trade up, reposition yourself in the market and make your money start working hard for you again.

The longer that you’ve owned a property, the more equity you’ve built up in it. Since Return on Equity diminishes over time, chances are that it has gone down in relation to how much wealth you’ve built up over time. In a sense, your money’s not working as hard for you as it once was when you first bought the property. If that’s the case, then it’s time to sell and trade up.

2. You’re thinking of doing a 1031 Exchange and owning more units or buildings.

Since we’re at the peak of the market, it might be a good time to consider selling your property to trade up to a bigger property because the leverage that you’ll get from that trade-up is highest when we’re at the top of the market.

A few months ago, a client sold a fourplex that was worth $1.5 million. After the sale, he was able to afford a 10-unit building for $4 million with the equity that he had in his previous property.

Had the market experienced a 6% drop in prices and his $1.5 million fourplex was suddenly valued at $1.4 million, this client would not have been able to afford the 10-unit building even if its value went down equally as his fourplex. He would not have had enough leverage for the down payment to afford that same building that he could have afforded when the market was still high.

So if you’ve been considering owning more units and doing a 1031 exchange, now is the best time to do so before a market correction that may or may not happen.

One of the major benefits of a 1031 exchange is that it allows you to defer paying capital gains tax which frees up all of your capital to put down on a replacement property. This is where tremendous growth happens for real estate investors. The number one reason there are more millionaires in the real estate industry than anywhere else is because of the 1031 exchange.

3. You want to consider alternative investments aside from residential or rental properties.

There are other ways of still getting cash flow through real estate: Delaware Statutory Trust, Triple Net Lease, and many more. Feel free to contact a member of our team for more advice on your options.

Why You Should Not Sell Your Property in 2022

1. If you’ve recently purchased your property.

From a Return on Equity perspective, your money is working hard for you, and there’s no real reason to sell until at least year 7 or 10 of owning it.

2. If you’re simply content with the properties that you own.

Sometimes investors are just content with what they have, and that’s okay. Not every investor is actively in wealth-building mode!

Final Thoughts

At the end of the day, investing in real estate is a long-term strategy. Most new investors typically look at real estate through a six to twelve month horizon, and that’s an amateur way to look at it. Unlike other markets where you can invest your money, such as the stock market or cryptocurrency market, the real estate market moves in a very slow pace. The stock market may rise by 20% on some days and drop 20% on other days. Cryptocurrencies can rise 5% one minute, and fall 10% the next. The real estate market isn’t like that, so you can’t really look at it from a six to twelve month perspective. You must look at it within a five to ten year horizon.

A lot of the clients and investors we work with don’t really worry about recessions or how the real estate market will perform, especially here in California, because real estate values always trend upward within 5 to 10 years based on historical trends. One of our dearest clients and another local investor, Brian Maginnis, once said, “I’m not smart enough to know whether the market will go up or down. I will buy [a property] when the bank will give me a loan.” None of them have ever looked back and regretted buying real estate, instead, they wish they could’ve bought more.

As we always say here at Sage Real Estate: “Real Estate is not get rich quick. It’s get rich guaranteed.”