If you’re a real estate investor thinking about selling your property or growing and diversifying your portfolio, a 1031 tax deferred exchange might be the right strategy for you. In this article, we’re going to discuss everything you need to know about a 1031 tax deferred exchange.

In this article we’ll look at:

- What is a 1031 Tax Deferred Exchange?

- Who is it for? Is it right for you?

- How it Works: All of the rules and timelines involved

- Getting Started with a 1031 Exchange

What is a 1031 Tax-Deferred Exchange?

A 1031 Exchange is a tactic that wealthy investors use to grow and diversify their real estate portfolio without paying any capital gains tax. Basically, you’re trading one asset into another and it defers the taxes into the future.

Who is a 1031 Exchange for and is it right for you?

If you’ve owned property for a while and you want to use that equity to grow and diversify your real estate portfolio then a 1031 exchange is the perfect way to do that.

The Benefits of a 1031 Exchange

Benefit #1: Deferring Capital Gains Taxes

One of the major benefits of a 1031 exchange is that it allows you to defer paying capital gains tax which frees up all of your capital to put down on a replacement property.

For example, in CA if you have a property and you’ve got $1,000,000 in equity, capital gains tax would take about $200,000 to $240,000 of that, leaving you with only $760,000 to $800,000.

The main benefit of a 1031 Exchange is it allows you to take 100% of your equity to purchase a larger, replacement property, or multiple properties to grow your portfolio.

Benefit #2: A 1031 Exchange Allows Real Estate Investors to Grow and Diversify Their Portfolio.

If you think of your money as an employee, you want to make sure your money is working as hard for you as it possibly can be. This is really great if you have a properties that are under-performing. They might not be cash flowing as well as you’d like or you’re having other problems with them and you’d like to trade it in for something else. By repositioning yourself by going from a smaller property to a bigger property, or from an under-performing property to one that’s actually going to perform the way you want it to you can maximize your return on your real estate investment portfolio.

Benefit #3: Maximize Your Return on Equity with a 1031 Exchange

Return on Equity is a real estate investment formula that’s extremely powerful and it really helps you determine if your property is performing as well you thinking it is. One thing that happens a lot with investors if they bought a property 10 or 20 years ago, the prices back then were much lower than today and it would seem that today the property is cash flowing very well. But what they don’t see is that they have a lot of their equity tied up in this property and that money gets lazy over time.

The longer that you own your property, the more equity you build, but also the return you get for that equity is diminishing over time. This is a really powerful formula that helps you determine if a 1031 exchange is right for you.

1031 Exchange Timeline

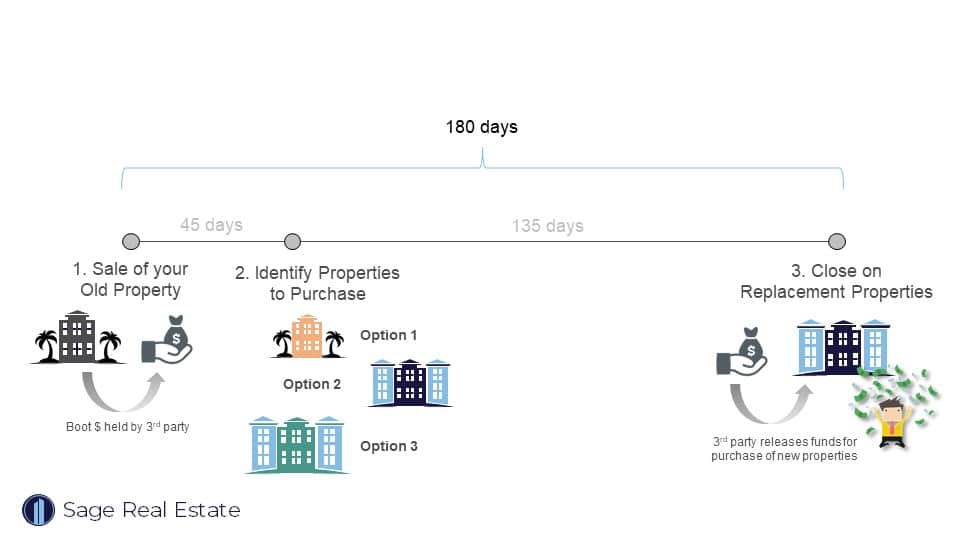

First you sell your property and the proceeds from the sale, which is called the “boot,” are held by a qualified third party intermediary. You never get to touch the funds.

From the sale of your property you have up to 45 days to identify replacement properties to purchase. Then you have an additional 135 days to close on those replacement properties. When you identify the properties you’re going to purchase and go close, at that point the funds are released from the third-party intermediary and are transferred to the purchase of your replacement property.

The really important thing in all of this is that you have 180 days from the sale of your property to close on a replacement property. From the sale of your property you have up to 45 days to identify replacement properties. You could identify properties sooner (in 10 days or 20 days) and you have the remainder of the 180 days to close on those properties.

Rules for Identifying Properties in a 1031 Exchange

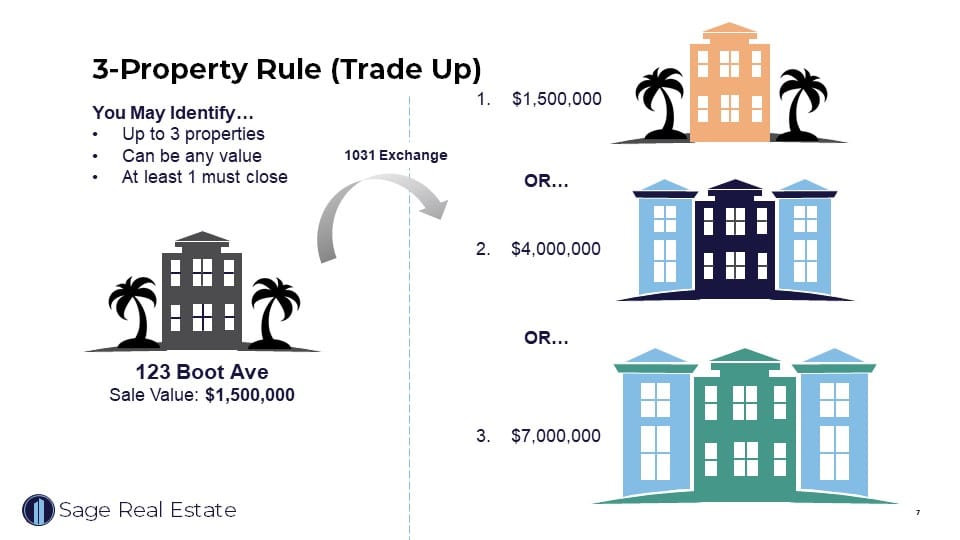

The Three-Property Rule

This rule is by far the most commonly used. It’s typically used to trade up. If you want to trade your property for a single, larger property then the 3-property rule is probably what you want to use. you can identify up to 3 properties of equal or greater value and you must close on at least one of them.

As an example, if you sell your property, 123 Boot Ave and you sell it for $1.5M, then you can identify up to 3 properties that are at least $1.5M each. So you could identify 1 property for $1.5M, another for $4M and another for $7M. There is no upper limit to the value of any single property.

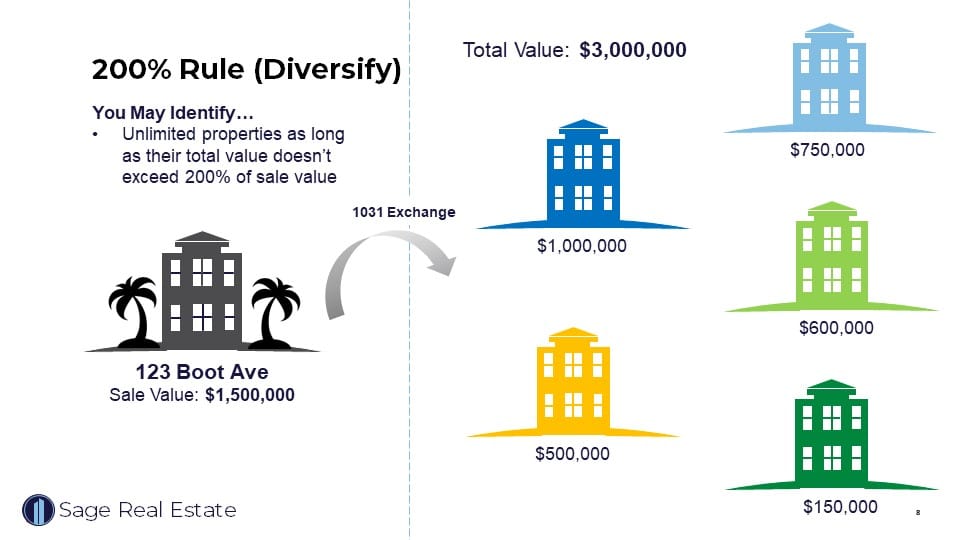

The 200% Rule

Use this if you want to diversify your portfolio. You can identify unlimited properties as long as their total value as long as their value doesn’t exceed 200% of the sale value of your property.

If you sold your property for $1.5M, then you can identify unlimited properties as long as their combined value doesn’t exceed $3M. In the example below, the combined value of the replacement properties is $3M.

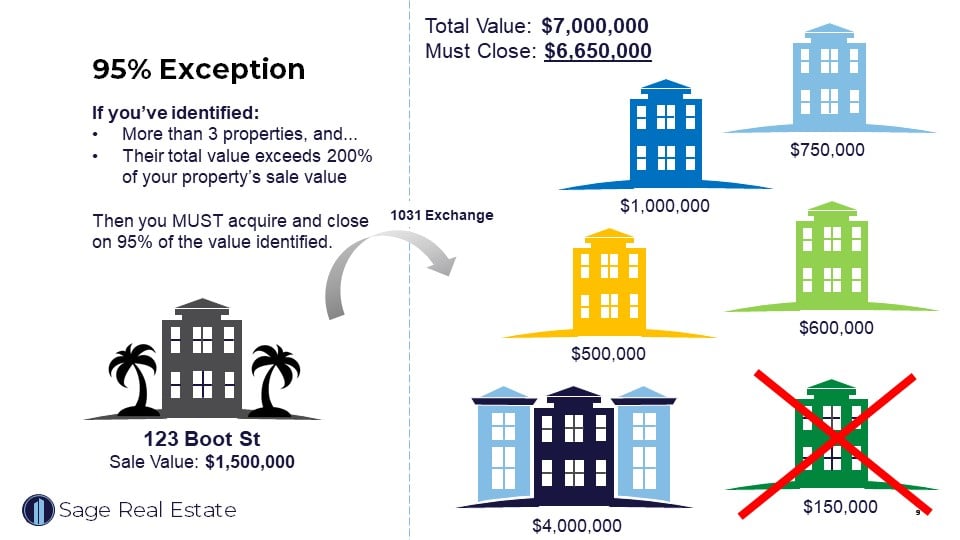

The 95% Rule/Exception

But what happens if you break both of these rules? You’ve identified more than 3 properties and their combined value exceeds 200% of the sale price of your property. In this example, you’ve identified 7 properties and their combined value is $7M.

This exceeds both the 3-property rule (too many properties) and the 200% rule (their combined value exceeds 200% of the sale price). You can use the 95% rule which says you can identify unlimited properties with unlimited combined value, as long as you close on 95% of the value of the identified properties.

In this example, for the 7 properties you’ve identified whose combined value is $7M, you must close on $6,650,000 worth of properties. To meet that requirement, if you don’t close on the $150,000 property that’s okay as long as you close on all of the others.

Like-Kind Property Requirement:

When you’re identifying properties, they must be a like-kind property. What that means is that if you have an apartment building, you can’t 1031 exchange into a single family residence for yourself, or into a house that you want to flip.

If you have an investment property that you purchased with the intent to hold, then you need to go purchase another investment property for another that you also plan to hold. You could trade your multifamily property for a shopping center or office space as long as you intend to hold it.

How to Get Started with a 1031 Exchange

The next step is to find out your property’s Return on Equity. If you have a real estate agent you’re already working what you can go and talk to them, but a lot of agents don’t know this formula. It really is a little-known formula in real estate investing. If you want help you can always come to us and we’ll help you figure out how your building is performing and give you your return on equity.

Once you’ve decided you want to do a 1031 exchange, the next step is to list your property for sale to enter the 1031 exchange. Talk to a real estate professional and make sure you’re working with a qualified tax professional who deals with 1031 exchanges.

And that’s everything you need to know to get started on your 1031 exchange!