There’s a little-known formula in real estate finance that turns small-time investors into millionaires. It’s counter-intuitive to the old adage that “cash flow is king,” and if you apply it and use it correctly, it will transform your financial future.

It’s called return on equity, and what you’re about to learn will change the way you look at investment real estate.

In this article we will explore:

- What is return on equity and why you should care

- How to calculate your property’s return on equity

- Why using this formula will make you rich

What is Return on Equity and Why You Should Care

Equity

Before we get into what is return on equity, first let’s get clear on what equity is. Simply put, equity is the amount of money you’d put into your pocket if you sold your property today. It’s the value of your property – what you owe the bank.

Equity = Property Value – What You Owe the Bank

Your equity builds up over time, and it comes from a few different sources:

- Appreciation: The increase in your property’s value over time (on average, 6.3% per year in Long Beach)

- Principal Pay Down: The part of your monthly mortgage payment that goes to paying down the principal of the loan

- Improvements: House flippers use this trick to boost their equity in a property

The longer you’ve owned a property, the more equity you’re likely to have due to appreciation and principal pay down.

Here’s a real life example from a client we recently worked with. He bought a fouplex in 2004 for $500,000. He put down $100,000 and mortgaged the other $400,000. This year (2021) we sold the property for $1,500,000. He still owes the bank $300,000. How much equity did he have?

Equity = Property Value – What You Owe the Bank

Equity = $1,500,000 – $300,000

Equity = $1,200,000

He had $1,200,000 in equity. In other words, it’s kind of like his property was a piggy bank with $1,200,000 sitting in it. Selling the property is like breaking open the piggy bank to get your cash out.

Return on Equity

Now that we’re clear on what equity is, the money you’ve saved up in your “piggy bank” (property), let’s talk about return on equity.

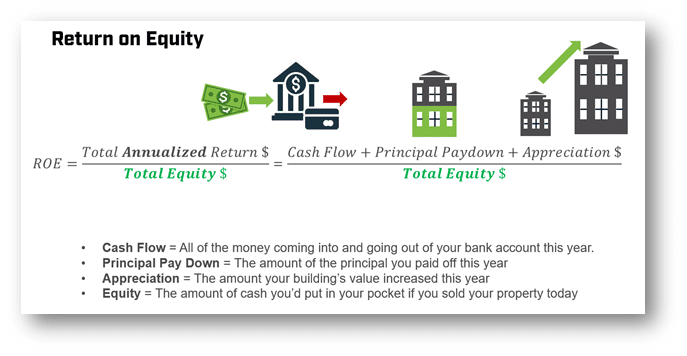

The formal definition of return on equity is your annualized return divided by total equity.

Return on Equity = (Annualized Return) / (Total Equity)

But that’s confusing, so let’s break that down and make it easy. Your “annualized return” is a fancy way of saying “how much your property gives to you every year.” And your equity is how much of your wealth is tied up in the property.

So we can re-write it like this:

Return on Equity = (How Much Your Property GIVES YOU Each Year) / (How Much of Your TOTAL WEALTH Is TIED UP In the Property)

Thinking about it like this, we can see that the BEST situation is when the top side of the equation is BIG (property is giving you a lot each year), and the bottom side of the equation is small (it’s not tying up much of your total wealth to own the property).

Annualized Return

The annualized return is what your property GIVES you each year. There’s 3 ways your property gives to you:

- Cash Flow: The amount of money that goes into your pocket each year after you’ve paid all expenses, taxes, insurance and mortgage payments

- Appreciation: The increase your property’s value over time

- Principal Pay Down: The amount of principal that has been paid off from your mortgage

So here’s my preferred way to write the return on equity formula, with some cartoons to make it easy:

The trick here is that most people don’t think about their property’s equity like they think about their cash in a bank because it’s less liquid, but the truth is that they are both part of your total wealth.

Why You Should Care

Your money gets lazy over time. The total equity you have in a property grows from one year to the next, meaning you get more and more of your wealth tied up in a property, but the property isn’t GIVING you a whole lot more in return.

Calculating your property’s return on equity will tell you when it’s time to sell and trade up, reposition yourself in the market and make your money start working hard for you again. This will make a lot more sense when we run through an example in the next section.

How to Calculate Your Property’s Return on Equity (ROE)

Let’s take a look at how you calculate your property’s return on equity by going through an example.

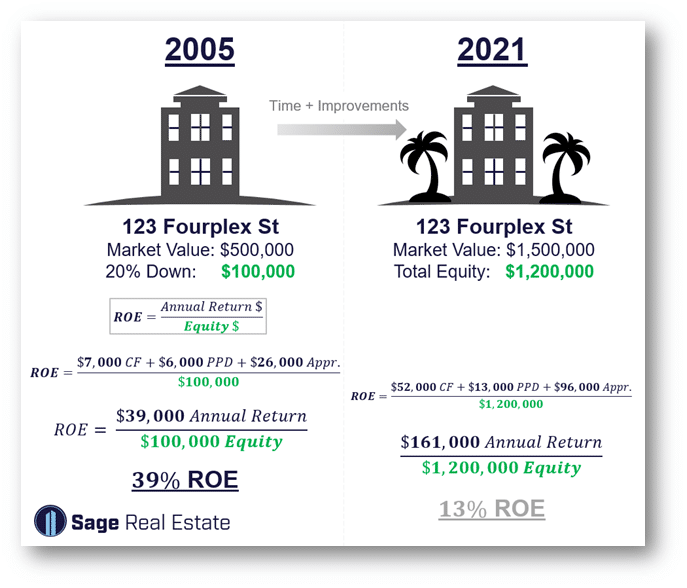

In 2004, 123 Fourplex Street was purchased for $500,000. The down payment was $100,000 and the other $400,000 was mortgaged. In the first year, it generated $7,000 in cash flow, $6,000 in principal pay down, and $26,000 in appreciation.

He only had $100,000 of his wealth tied up in the property, and the property gave him $39,000 in return for the year. That’s a 39% return on equity. Outstanding!

By the year 2021, 123 Fourplex Street appreciated to $1,500,000, and the owner owes $300,000 on his mortgage, so his total equity has ballooned to $1,200,000. Rents have increased substantially since 2004 and the cash flow has grown to $52,000 per year. Principal pay down was $13,000 for the year, and the property appreciated $96,000 that year alone.

For the $1,200,000 of his wealth he has tied up in the property, the property gave him $161,000. By the year 2021, our client’s ROE had plummeted from 39% (his money working hard) all the way down to just 13% (his money has gotten lazy).

While $161,000 sounds great keep in mind that it’s tying up $1,200,000 to get it, and could that $1,200,000 get him a better return somewhere else?

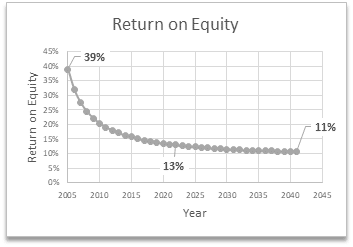

Return on equity pretty much ALWAYS decreases with time. If you were to plot this investor’s ROE every year, it would look like this:

While it varies from property to property, the shape of the graph usually looks something like this. The steepest drop-off happens in the first 7 to 10 years, and then the curve gradually flattens. This is why we recommend that our clients get regular ROE checkups, and sell or cash-out refi to get their money working hard again.

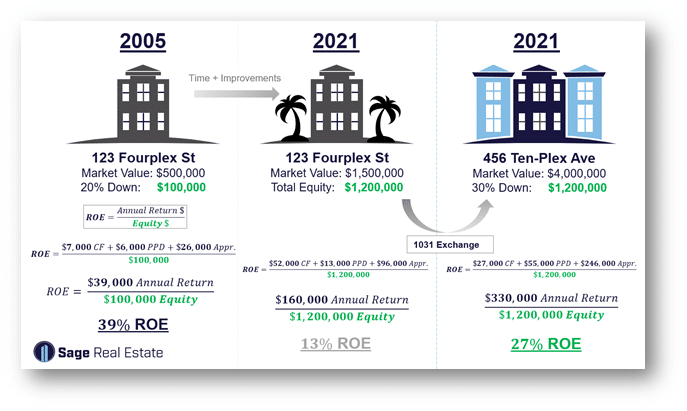

Here’s what that looks like. If our investor sells 123 Fourplex Street, and uses that $1,200,000 in equity as a 30% down payment to purchase 456 Ten-Plex Avenue for $4,000,000, what happens?

In his first year of ownership, Ten-Plex Avenue generates $27,000 in cash flow, $55,000 in principal pay down, and appreciates $246,000 for the year. In other words, the property gives him $330,000 for the year. By trading up, the $1,200,000 he had tied up in Fourplex Street that was giving him $161,000, is now giving him $330,000 and his return on equity has jumped from 13% to 27%!

Why Using the Return on Equity Formula Will Make You Rich

So WHY isn’t everyone doing this? Here’s the rub: they’re hung up on the cash flow. Fourplex Street was bringing in $52,000 a year, and when they trade up to Ten-Plex Avenue, the cash flow drops to $27,000.

They’ve been told over and over and over again how “Cash Flow is King!” and it’s just not true. Appreciation is King, and principal pay down is a close second, as we will soon see. Cash Flow is the smallest piece of the pie.

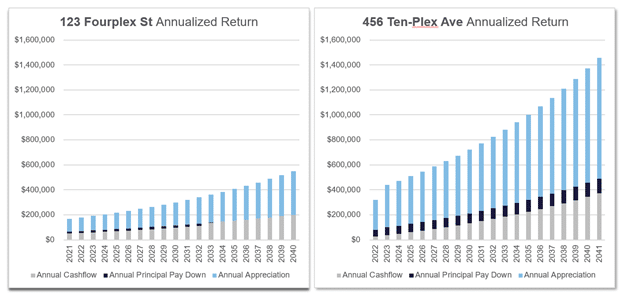

The charts below show the annualized return (what your property GIVES you, top side of ROE equation) for Fouplex Street and Ten-Plex Avenue starting this year. Each bar can be thought of as a pie chart for that year. You can see that the size of the bars for appreciation and principal pay down absolutely dominate. Cash flow is the smallest piece of the pie. Anyone who follows the “Cash Flow is King” motto is leaving literally millions of dollars on the table. The most money you’ll ever lose in real estate is the money you didn’t make.

We assume that:

- Cash Flow: Rents increase 5% per year. This is the 10-year average for LA county.

- Appreciation: Property values increase in Long Beach at 6.3% per year

- Principal Pay Down: Based on a 30-year fully amortized mortgage with a 20% down payment and 3.75% interest rate

Even if our assumptions are off (these are future projections, after all), they’re equally off for both properties. The relative size and shape of the charts remains the same. Viewed from this perspective, it’s obvious how people get rich in real estate, and it’s not by keeping the same building for 30 years.

That $1,200,000 in equity can either give you the annual return shown in the left chart, or the annual return shown in the right chart. Which would you rather have?

We tend to think that wealthy investors own big buildings because they’re wealthy, but that’s putting the cart before the horse. They’re wealthy because they own big buildings.

Do what wealthy investors do: Know your property’s ROE, trade up, and reach out to a qualified real estate professional to help guide you through the process.