Whether you’re thinking about buying your first rental property or your next real estate investment, mistakes can be very costly. We’ve worked with hundreds of investors over the years, and here are five amateur real estate investor mistakes that we have frequently seen over and over again.

Anybody willing to invest in real estate is looking for passive income. They’re looking for appreciation. They’re looking to hopefully retire someday. These are all positive attributes, but then, again, there’s something that typically people back from taking the first step of buying a rental property. This first mistake is commonly what causes investors to miss out on passive income, appreciation, and ultimately a good investment deal.

Mistake #1: Waiting for Property Values to Drop

Whenever I hear a client say “I’m waiting for prices to drop”, typically they end up waiting and waiting and waiting, and they never take that first step to really get the ball rolling to get their foot in the game.

Everyone wants to get the best deal when they’re buying a property, and no one wants to feel buyer’s remorse. Because of this, people tend to hold out on buying a property to wait for the “right moment” when hopefully prices are at their absolute lowest and interest rates are low. Unfortunately, timing the real estate market is not only very difficult and close to impossible to do, but it can also be an expensive mistake for any real estate investor.

It’s about time in the market, not timing the market.

One of the things that we always tell buyers and new investors is that it’s not about timing the market, it’s about time in the market. Because the real estate market is truly unpredictable and each market varies based on where the property is located. There’s no way to say with 100% certainty where mortgage rates, property values, and other market trends will go towards.

It’s about owning a business that generates passive income.

It’s simply all about jumping in the game, buying that first property, and finally getting started. Because when you buy your first real estate investment, three things happened that day you close the escrow: You become a landlord, you become a business owner, and you become an entrepreneur that same day.

The best part is, the rental property that you’ve purchased is real estate business that already has customers lined up waiting for that product from day one. It’s also a business that you don’t have to be present at every single day. Some of the properties that we own, we typically check on them once a month or every other month because it’s not a demanding business. It’s not a business that you have to go clock in and clock out of.

It’s about not missing out on the appreciation of property values.

Waiting to purchase a real estate investment also means missing out on all the wealth you could build thanks to the appreciation of housing prices.

Two years ago, we had a client that wanted a property that both had cash flow and appreciation. We know here in Southern California, you’re guaranteed appreciation no matter what, because we’ve been experiencing a half-century-long housing shortage. However in California, it’s really difficult to get a property to cash flow positive within its first year. The client eventually backed out of buying a property two years ago, but then recently mentioned their regret and mistake of not taking advantage of the appreciation that properties in California experienced since 2020.

The income of today is not the income of tomorrow. If the buyer had bought the property in 2020, its value would have appreciated by 20% or more by now. Waiting longer caused them to be in a situation in which their net worth is 20% to 40% less than what it should have been if they stepped into the investing game and got time in the market.

When you own a property, you can increase your cash flow.

The beauty of owning real estate investment properties instead of stocks or cryptocurrency is that you have the ability to make tangible strategic upgrades to your investment that can increase its cash flow and value. However, until you purchase and own a property, you can’t be in the driver’s seat to make the necessary upgrades as an owner and implement strategic decisions to increase its income and value.

The best example is when Warren Buffett buys a business. He’s not buying it because it’s a perfect company that’s well-managed and producing a lot of annual revenues. He’s buying that company because he believes that he and his team can improve it. They can add value and over the long run, they know that the investment is going to be a success. Seasoned real estate investors know to take that exact same approach when we’re looking for a property instead of waiting for prices to drop.

In another instance, a buyer we were working with wanted a property that brought income at least $500 more a month than what was available in the market at the $1,000,000 price point. It’s not a tremendous amount of cash flow, but it’s something that held them back from purchasing a property.

Looking at the numbers, $500 per month equates to $6,000 for the year, but subsequently, that same property has also gone up by 6.3% since a year ago. That’s almost $63,000 in appreciation. So for every year, you’re missing out on at least $63,000, but appreciation is compounding every year so you’ll miss out even more. Essentially this buyer cost themselves over $150,000 of equity. Simply because they were chasing $6,000 more cash flow per year.

If we were to ask most of the clients and investors that we work with, “Hey, would another $6,000 a year really be monumental to where you’re at in life?” Usually the answer is “no”, but if you consider that $63,000 worth of appreciation over a 12 month period, usually the answer changes to “yes, that would change my life quite a bit.”

Mistake #2: Failing to Know If You’re Qualified to Buy or Not

When people are thinking of buying rental properties, they usually browse for listings online or contact a real estate agent. However, these are not the first steps you need to be taking when you’re about to get serious about investing in real estate.

The first step is figuring out whether you even qualify for a mortgage or not, especially if you’re thinking about financing your purchase. Finding out whether you qualify for a mortgage costs nothing. Just a little bit of time, a little bit of energy, and it’s completely free.

It’s so common for someone to ask us about how much the down payment is going to cost or how much the monthly mortgage payment is going to be. Those are questions that real estate agents and brokers cannot accurately answer because only a trusted mortgage loan officer or broker can tell you those answers based on the financing options they are able to find based on the financial information you provide them.

It doesn’t cost you anything to know whether you’re able to purchase a property or not. There’s no risk to your credit score and there’s really no downside.

You’ll have so much more peace of mind when you actually take that first step. Getting in touch with a lender is a quick and easy process that tells you if you’re qualified to buy, how much you’re able to borrow, and the price range of properties you’re qualified to buy.

Sage Real Estate has its own in-house mortgage division in California and can refer you to our nationwide affiliates. Talk to an expert today!

Even if you don’t qualify for a mortgage just yet, it’ll give you an indication that maybe this is time to fix your credit. Maybe it’s time to pay off some debt. Now, during this time, it’s also probably not a good idea to go buy a new car and put some new debt on your portfolio.

Lastly, even if you qualify, no, one’s going to push you to buy a property. Ultimately you still have all the control and a lot of what we’re teaching from our method of investing is all about having control.

Mistake #3: Not Knowing Your Intention for Buying the Property

You need to really ask yourself: Is this an investment that I’m going live in?” because that makes a huge difference in the buying process.

If you decide to live on the property, there is a certain utility function. The property will serve as your primary residence, much like a single-family home or a condominium. When you’re buying a property for that purpose, you don’t really have to factor in the numbers or financials of the deal.

Instead, you’ll usually have to consider other factors such as the safety of the area around the property. You need to know if you’re going to be comfortable living on the property. While the numbers are obviously always important, they’re not as important if you’re gonna be living there. It’s your home and that’s an important intention to figure out before deciding to buy a property because that can play a big role in the way that we analyze every potential candidate.

It’s also important for the real estate agent you’re working with because it makes it difficult for them to filter and find the right properties to show you. Not knowing whether you will live on the property or not casts too large of a net of options in this type of situation.

Plus, today’s real estate market is super competitive. There’s not a whole lot of inventory available to buyers. So the sooner you’re able to decide your intention for a property, the sooner you’ll have a game plan which will help your real estate agent in finding the right deal for you. If you’re buying the property as an investment, that’s when the numbers and financial metrics matter.

One last detail to add is that you don’t have to live on the property forever. So even if your intention is to live there for one or two years and then move on to the next property, or maybe you need to upgrade to a house for a little bit more room, you still have the flexibility until you purchase the next property.

You don’t have to stay at the property forever, but knowing your intention for the initial phase of your ownership is definitely important to understand.

Mistake #4: Not Specifically Focusing on One Area or Property Type

When most new investors approach real estate professionals, they tend to cast a wide net when searching for properties. The search criteria would feature a list of many cities or counties and a huge range of property types from a duplex to 5 units or more. That lack of focus makes it really difficult, not only for you as the investor, but for whichever real estate agent you’re working with as well because focus is everything especially when the real estate market is as tight as it is today.

You need to make sure that you have a clear understanding of the specific areas and property types that you want. This is an important detail to know, especially if you’re purchasing your first rental property. The best advice we can recommend is that you should go with the area you’re most familiar with because you’re going to be more comfortable with that location. You’re going to know the businesses and the places to shop. You’re going to be familiar with one area from the other.

Purchasing a property is a huge commitment and can sometimes be very stressful for new investors, so having that comfort, peace of mind, and familiarity with that location is going to give you that much more confidence to really keep pushing and finally own real estate.

What about when it comes to deciding on a property type? When it comes to deciding whether you want to buy a property with two units, three units, or four units, the best way to determine that is by looking at your intention. Are you going to live on the property? And if so, are you comfortable with having two or three tenants living next to you? Figuring out what you’re comfortable with is really important.

Knowing the exact type of property you want will also help you have some clarity on your down payment. For example, if you’re looking to apply for an FHA loan with a minimum down payment of 3.5% in Southern California, you’re probably going to be focused on finding two-unit or three-unit properties.

While some might argue that it’s possible to obtain an FHA loan for a fourplex, only less than 1% of applicants have been successful with obtaining an FHA loan on a four-unit building in Southern California because of what is known as the Self-sufficiency Test. So typically when people contact us and they’re pretty adamant about getting an FHA loan, we typically have to steer them towards a duplex because it’s much more possible to obtain an FHA loan for that property.

When you know where you want to purchase and what type of purchase you want to make, it puts you and the real estate agent you’re working with in a better position to succeed.

Mistake #5: Analyzing Too Much and Failing to Take Action

The fifth and final mistake that we see early and amateur investors make is what we like to call “analysis paralysis”.

Fear of an Economic Recession

Many people also fail to “get in the game” of building their wealth in real estate and are waiting simply because they’re afraid of all the things they can’t control. One of which is the fear of an incoming economic recession.

While it may be a valid fear, it’s not always a sign of panic in the world of real estate. Anytime there’s some level of economic uncertainty, investors want to factor it in, but what most people fail to realize is that with the exception of the 2008 recession and market crash, which was an outlier that we’ll likely never see again, during three of the last four recessions property values actually increased. During the last recession caused by the COVID-19 pandemic, property values actually skyrocketed all over the nation.

So if the United States experiences a recession, the odds are properties are still gonna go up and value. As an investor, you want make sure you’re on the positive side of that property value growth and appreciation.

If historical trends have shown us anything significant, it’s the fact that during the majority of recessions purchasing real estate has actually been a secure hedge against that inflation and downward economic trends.

Fear of Rising Interest Rates

The constant media coverage of continuously rising mortgage interest rates has not only decreased the rate of property value appreciation due to bidding wars amongst buyers, it has also discouraged many first-time buyers and real estate investors from jumping into owning a property.

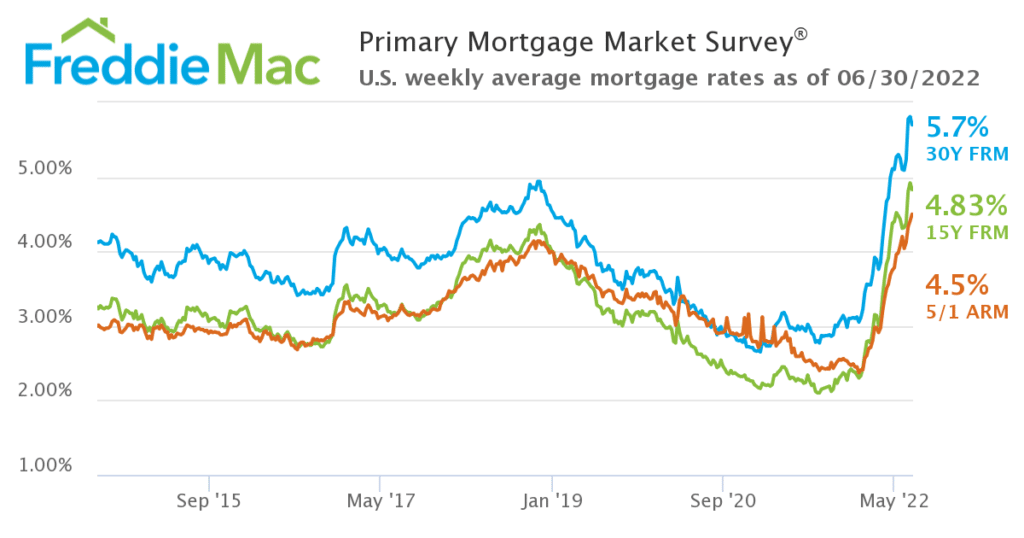

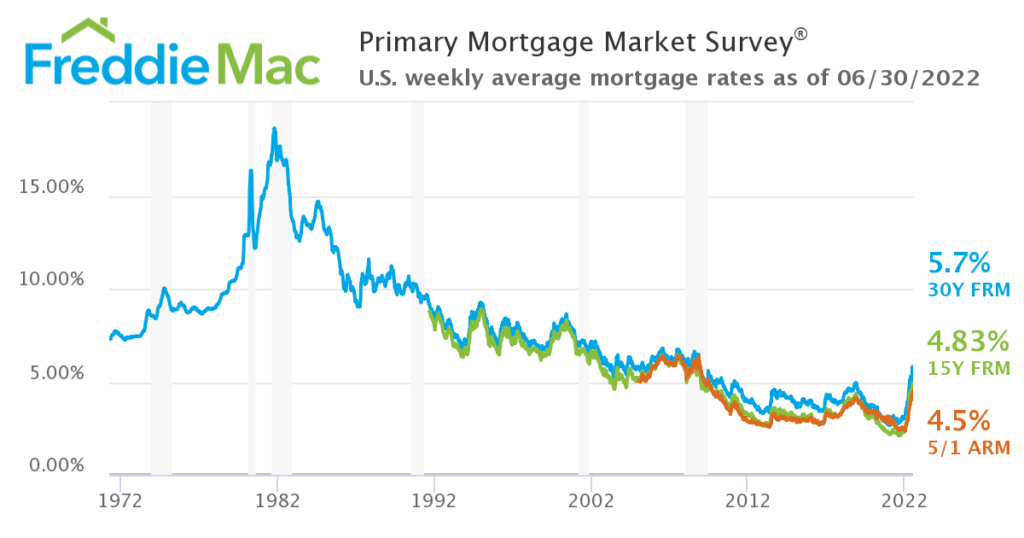

It’s true that interest rates have obviously increased significantly in 2022 and it may seem like a ridiculously high jump in a short amount of tie, but the truth is that we’ve been so spoiled for the last few years with these super advantageous and extremely low interest rates. If you look at the graph below, you’ll notice that interest rates during the last three years before 2022 have remained below 4% and even went as historically low as a bit above 2%.

When you zoom into the speed at which mortgage rates increased over this short period of time, it’s easy to panic. It’s easy to be afraid and discouraged from purchasing a property today. However, the real picture becomes much clearer when you zoom out and see the whole playing field.

Our team at Sage Real Estate has worked with numerous longtime investors who purchased rental properties from about 20 to 30 years ago when prices were definitely a lot lower, but the interest rates were around 10% to 12%. So when you look at the last five to six years as a snapshot compared to other decades, we’ve actually had extremely favorable interest rates.

I would still state that today’s interest rates are still considered to be advantageous and are definitely worth monitoring. But again, I think we’ve been so spoiled with the current interest rates during these recent years that a small uptick can be a little bit shocking for most people.

It’s also important to stress the point that you’re not going to see real estate prices drop along with interest rates. Those two things have never followed the same pattern and it has never happened in the history of real estate.

Real estate prices and interest rates typically follow an inverse pattern and one drives the other. This explains how real estate investors who purchased properties many decades ago were able to do so at low prices but with high interest rates. Today’s property values are significantly high and some properties are overpriced, but mortgage interest rates still remain low compared to when they were above 10% decades ago.

What really matters is your down payment, not your interest rate. When you finance a property with a 15-year or 30-year fixed mortgage, you’ll have peace of mind knowing that no matter what happens with the economy, whether a recession comes or property values fluctuate.

The most important part is that you’re comfortable with that monthly down payment. It’ll be the same for 360 months or for 30 years. So knowing that having a fixed payment will give you the peace of mind to finally make that purchase. Being a great real estate investor is all about having control all throughout the entire process of building your wealth. Having peace of mind and control over your monthly payment is one way of having control.

Fear of Rising Property Values

“It’s too expensive to buy a property, I think I’m just going to continue renting”. It’s sadly a pessimistic outlook that we keep hearing nowadays from new or aspiring investors. They seem to have the idea that renting is cheaper than paying a monthly mortgage payment. While that idea may be partially true on the surface, deep down there’s a huge piece of the iceberg that they’re not seeing.

We know for a fact that rents are only going to go in one direction and that’s upwards. For most people and businesses, rent is their biggest monthly expense. The downside to having rent as your biggest expense is that you have no control over it, because it is primarily determined by the landlord that you’re renting the property from.

However, if you have a mortgage payment that you’re comfortable with paying every month, you’re putting a limit to your biggest expense and that expense is going to be the same for the duration of your mortgage term. When you own a property, nobody can raise your monthly costs. When you own a property, no landlord can give you a 30-day notice to move out. Ownership gives you control unlike renting. You won’t have to worry about someone else raising your biggest monthly expense by 10% every year and you’ll sleep better at night.

Depending on the location or type of property, sometimes the cost of paying a monthly mortgage is cheaper than paying rent. In other instances the opposite is also true. However, people only see the face value on the surface, and they’re missing out on a whole set of benefits that come with ownership. For those who own rental properties, there are tax benefits to being a landlord that people fail to factor in.

Analyzing Property Metrics the Wrong Way

When it comes to analyzing the financials of a rental property, there are a lot of metrics and numbers to look at, so sometimes it can be overwhelming.

There are typically six metrics that every experienced real estate investor and real estate broker can use to analyze any property:

- Price per Square Foot

- Price per Door / Price per Unit

- Cash-on-Cash Return

- Capitalization Rate (Cap Rate)

- Gross Rent Multiplier

- Return on Equity

Try out our Multifamily Rental Property Calculator so you can instantly analyze any investment property!

A lot of these metrics are market-driven, which means that they’re mostly out of an investor’s control. On top of that, some of these metrics such as Gross Rent Multiplier and Return on Equity require an experienced real estate professional to obtain and understand. Yet most new investors tend to over-analyze these metrics and oftentimes fail to properly understand what the numbers tell them.

Someone once approached us about buying a rental property that they can live in while renting out the other units, but kept backing out of a good deal because the property’s Cap Rate was not favorable enough. What this potential buyer failed to understand is that you can’t truly calculate the true Cap Rate of a property if you’re planning to owner-occupy or live in one of the units. Because when you’re occupying one of the units, you’re basically taking out the potential income of that unit and affecting the overall income of the property, which will affect the calculation of every other property metric. In the end, you’ll end up with unfavorable numbers which will make you mistakenly think that the property is not a good fit for you.

Let’s take a duplex for example. If you’re going to live in one of the units, you’re going to have to calculate these six metrics based off of one unit’s rental income and that becomes really difficult to do. In fact, calculating a Cap Rate on a duplex at all is difficult to do.

There’s always a margin of error when calculating these metrics and also a risk of misunderstanding them, so we recommend that you work with a trusted real estate professional who is an expert with multifamily real estate and rental properties. You can learn more about how to choose the right real estate agent in this article.

Fear of Foreclosures or a Housing Market Crash

Just like how most amateur real estate investors are waiting for prices to drop, others are waiting for a wave of property foreclosures or a housing market crash similar to 2008 to happen so they can take advantage of discounted properties on the market. My response to that is to typically look at the level of equity that people have in their properties after the last housing market crash of 2008.

Aside from horrible banking regulation and loose mortgage lending standards, of the main reasons we experienced a wave of foreclosures and drop in real estate prices is due to the fact that in 2008 homeowners and landlords were harvesting equity from their homes like it was an ATM. In most cases, these same people owed more money than what their homes were worth.

Unlike the recession in 2008, the recession caused by the 2020 COVID-19 pandemic did not bring in a wave of foreclosures or a housing market crash. In fact, the exact opposite happened as we all know today.

The reason for this pattern is that homeowners and landlords now have a historical record of massive equity that they have built up over time due to the appreciation that we’ve been able to reap over the last several years, especially here in Southern California. It also seems like everyone has learned from the lessons of 2008, and homeowners are treating their home equity more cautiously.

That’s why if something financially drastic were to happen to a property owner and somehow they can’t make their payment, they can just sell the property.

According to CoreLogic’s Homeowner Equity Insights, the average homeowner’s equity in the United States grew from 2021 to 2022 by about $64,000. For Californians, the average homeowner gained an equity of $141,000.

For example, if you bought a single-family home in Southern California back in 2021, you’d have an extra $141,000 in equity just for owning that property. Imagine just how much equity the average homeowner is sitting on today after years and years of appreciation. So if God-forbid you can’t make your next mortgage payment, you’re not going to lose your property. You’re not going lose your property because your equity is sort of a safety net or a reserve bank account that’s built into that property as a result of it increasing in value over time. In order to access that equity during difficult financial times you can either perform a cash-out refinance or sell your property.

So will there be a wave of foreclosures happening just like in 2008? Absolutely not. Why? Because of how much equity the average homeowner has today because of the appreciation they’ve experienced over the last decade. If there really is a wave of foreclosures, you bet we’ll be hunting for them right now instead of writing this article. As investors ourselves, we’ll be in front of the line searching for deals and telling our clients about them. But alas, there’s no wave of foreclosures anywhere in sight.

Will there be a real estate market crash? No, but there could there be a market correction. More accurately, there will be a deceleration in the rate of property value increases. The rapid rate at which housing prices keep climbing will experience a slow down, but the chances of property values actually dropping are very slim. In my opinion, it might stabilize. It might slow down and return to its normal speed and its normal activity that we’re used to seeing historically.

Fear of a Property Losing Its Value

In super rare scenarios, what happens if you buy a property worth a million dollars and it drops? Let’s just say there’s a 10% reduction in price, which brings its value down to $900,000.

Did you technically lose a hundred thousand dollars? No, you did not. You only lose if you sell it at that price. However, if you’re planning to hold the property for several years, you can almost rest assured that it’s going to return to its initial value or even exceed it in the next year that follows.

So when the prices drop, you haven’t lost anything until you sell. Even if the value of the rental property drops and fluctuates over time, the tenants will still keep paying rent. The units you own will still generate income. The mortgage will still be paid. While a possible 10% price reduction might seem scary at first, it won’t be as scary when you actually dive into the numbers and see the big picture long-term. There’s a lot of benefits that come with owning properties and obtaining fixed financing for 30 years. Learn more about these benefits from this article about Return on Equity.

Final Thoughts and Conclusion

When you decide to invest into multifamily rental properties, you’re investing in a product that is always in demand. People are always waiting in line for someone to move out or sell because we have lack of housing, not just in California but also nationally. There’s simply not enough houses for everyone yet everyone needs a place to live and it’s the biggest monthly expense for most people.

The more control you have as a real estate investor, landlord, or homeowner, the more likely you’ll succeed in building wealth through real estate.

I hope this article was insightful in helping you avoid common investor mistakes and eased some of your fears about jumping into owning a rental property, but ultimately the decision of being an investor is all in your hands.