It’s been proven time and time again that investing in multifamily real estate is one of the safest ways to generate cash flow of passive income and to build wealth. After all, 90% of millionaires built their wealth through investing in real estate.

So how do you buy a multifamily property (such as a duplex, triplex, or fourplex) if you don’t have all the cash on hand? You need to look into getting a mortgage loan to finance it! In this article, we’re going to cover everything you need to know about financing a multifamily apartment building in 2022.

When learning how to buy a duplex or other multifamily unit, there are unique characteristics you will not encounter with a single-family home mortgage. If you want to follow in the footsteps of successful real estate investors and finance the purchase of a multifamily apartment building for yourself, this article is a wonderful place to begin your journey.

Here’s what we’ll discuss:

- Why Financing a Multifamily Property is Better Than Paying Cash

- Choosing Between a Mortgage Broker vs. a Direct Lender

- Financing Terms to Know

- Interest Rates

- Loan Terms

- Loan Limits

- Loan to Value Ratio

- Different Types of Multifamily Mortgage Financing Options

- Conventional Multifamily Mortgage Loan

- Minimum Down Payment for Multifamily Properties

- Maximum Loan Limits for 2022

- Qualifying for a Multifamily Mortgage Loan

- Government-backed Multifamily Loan (FHA Loan)

- USDA Loans for Multifamily Properties in Rural Areas

- Paying Zero Money Down with a VA Loan

- Non-Qualified Mortgage Loan

- Bridge Loan vs. Hard Money Loan

- Private Party Loan

- Seller Carry-back Note

- Conventional Multifamily Mortgage Loan

- Other Frequently Asked Questions on Multifamily Financing

- How many mortgage loans can an individual have?

- Is it a good time to refinance my property in 2022?

- Qualifying for a Mortgage with Income from Stocks or Cryptocurrency

Why Financing a Multifamily Property is a Better Strategy Than Paying Cash

In the world of real estate investing, the cash versus financing topic has been debated heavily online. Each method of purchasing a property has its own advantages and disadvantages, however, which works best depends on the factors of the deal. While paying cash for a multifamily investment property certainly offers a ton of benefits such as avoiding paying interest or skipping the entire mortgage loan application process, most first-time real estate investors cannot afford to pay for a property in full.

The main benefit of financing a multifamily property with a mortgage loan is leverage, which is simply explained as making money on the bank’s money. The logic behind this method is that if the property appreciates in value over time, then the investor can receive far more than the capital they initially invested once they sell the property. Below are a couple of example scenarios:

Scenario A: You buy a $1,000,000 fourplex apartment building with cash. Two years later, the property appreciates in value to $1,200,000. After deciding to sell the property, your $1,000,000 initial capital investment is returned with a direct profit of $200,000. Only a 20% return on investment.

Scenario B: You finance the same $1,000,000 fourplex apartment building with a conventional mortgage loan after paying a 25% down payment of $250,000. Two years later, the property appreciates in value to $1,200,000. After deciding to sell the property, your initial capital investment of $250,000 is returned, with an extra $200,000. In this case, you receive an 80% return on your investment.

If you multiply this strategy’s formula over two or three properties, a savvy real estate investor could profit tremendously. Therefore, an investor with leverage has more opportunity and less risk than an investor who uses cash in most multifamily buying situations.

However, it is important to note that any type of investment has an inherent risk; especially with uncertainties in the real estate market. While there are certain significant advantages to having leverage, you should not risk being over-leveraged and owing too much money in case the market collapses.

Choosing Between a Mortgage Broker vs. a Direct Lender

The mortgage industry is full of professionals and institutions that help people like you gain access to financing one of the biggest investments you will probably make in your life. It is important to understand your options before making this decision. While many first-time investors think that they initially need to speak with a real estate agent, the first step to financing a multifamily property is speaking with a mortgage broker or direct lender. This is the first and one of the most important decisions you’ll make as an investor.

While many professionals tend to use these two terms interchangeably, they are significantly different.

What is a Direct Lender?

A direct lender, mortgage lender, or mortgage lender is a financial institution or private entity that provides the funds for a mortgage loan. This category includes banks, credit unions, and major online lending companies such as Quicken Loans. When working with a direct lender, loan officers serve you just like salespeople do at car dealerships.

What are the Pros and Cons of Working with a Direct Lender?

Pros:

- You may get a better interest rate and lower closing costs.

- Some institutions have “direct-only” mortgage deals that aren’t avaible elsewhere.

- You don’t have to pay mortgage broker fees.

Cons:

- You are only limited to the lender’s mortgage programs.

- If you don’t fit into one of their mortgage programs, you don’t have many other options.

- If for any reason you don’t get approved with one lender, trying another lender will trigger multiple credit inquiries which can hurt your credit score.

What is a Mortgage Broker

A mortgage broker is an intermediary financial professional who works as a matchmaker between you and direct lenders. They are not lenders, and they do not use their own funds for a mortgage loan. As intermediaries, they get a commission from the direct lender, the buyer, or in some cases both parties when the property sale has finally closed.

The main advantage of hiring a mortgage broker is to have the convenience of a one-stop-shop with the ability to compare a variety of financing options customized to your own qualifications and investing goals. These intermediaries also help buyers navigate through the complex landscape of lending institutions as they most likely have more knowledge of possible financing options compared to the average investor.

What are the Pros and Cons of Working with a Mortgage Broker?

Pros:

- You can gain access to multiple direct lenders

- Brokers can provide a customized variety of financing options based on your investing goals

- You’ll have an idea of what you can qualify for without hurting your credit score

- If you don’t qualify for a loan or don’t fit the average borrower profile, brokers can advise about other non-conventional financing methods

Cons:

- You may have greater closing costs when working with a broker

- Some lenders refuse to work with brokers

- Brokers often charge their commission fees to the buyer

Regardless, a great mortgage broker can help you find the best financing options that fit your goals as an investor. When it comes to financing multifamily properties, it is extremely important to work with a broker who specializes in multifamily mortgage loans as opposed to a broker who might only be familiar with common single-family residential mortgage loans.

*If you’re looking to purchase a multifamily property in California, Sage Real Estate has its very own mortgage division of brokers who can work with you.

Multifamily Financing Terms to Know

Interest Rates

What is a mortgage rate or interest rate?

Whenever you receive a mortgage loan from a lender, you promise to pay back the loan at an agreed-upon interest rate. Of all the factors you need to consider when deciding on a mortgage loan, it’s the most important one. Interest rates vary significantly depending on the lender, the merits of the deal, and the quality of the borrower.

How are mortgage interest rates determined?

In today’s economy, several factors may affect how interest rates are determined. Interest rates are generally affected by the overall health of the economy. When economic times are good, interest rates tend to go up, and they go down when times are rough. While every other factor is out of your control, the main factors you can control are your personal factors: down payment, loan-to-value ratio, debt-to-income ratio, and credit score.

How do interest rates affect my mortgage payments?

Simply put, a lower interest rate means a lower mortgage payment. However, that also means higher interest rates weaken your buying power, forcing you to shop for a property in a lower price range.

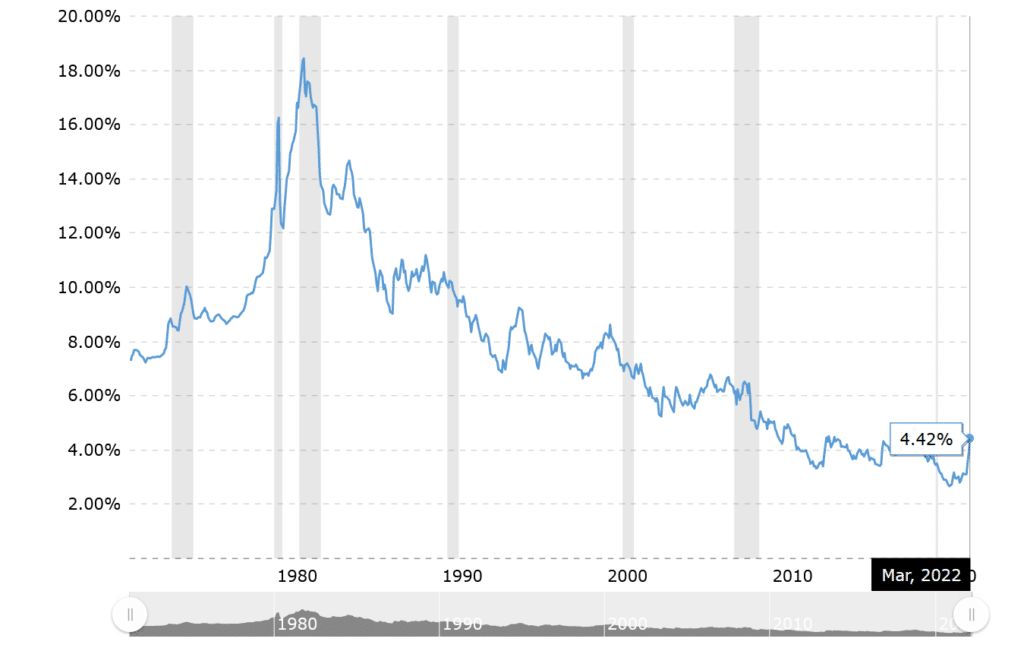

What’s the trend of mortgage interest rates in 2022?

Mortgage interest rates are likely to continue rising because they tend to move in the same direction as the federal funds rate. With the anticipated increases, mortgage interest rates could trend upward all year. If you have already signed a contract to buy a property and have locked an interest rate with a lender, you’re in good shape. The lender can’t raise your rate.

However, if you’re shopping for a property or plan to do so in 2022, mortgage interest rates might be higher by the time you get a purchase offer accepted. You can’t lock an interest rate until you have a contract to buy a property.

It is important to also note that rising mortgage interest rates should not discourage you from buying a multifamily property in 2022. According to this historical chart from MacroTrends, we’re still at historically low interest rates compared to earlier decades.

Owner-occupied vs. Investment Property Mortgage Loan Rates

Mortgage lenders want to make sure that prospective borrowers are capable of keeping up with the financial demands of owning a multifamily investment property.

An owner-occupied property means that you, as the owner, are living in one of the units of the property. An investment property means the opposite, and you intend to own the property for monetary gain instead of using it as your primary residence.

From the perspective of a lender, an owner-occupied property mortgage loan has less risk compared to an investment property mortgage loan. Therefore, the difference in interest rates for an investment property compared to an owner-occupied property could cost up to a percent more for borrowers.

How to get a lower investment property mortgage rate?

- Have a great credit score. A minimum of 640 credit score will allow you to qualify for an investment property mortgage. A score of 700 or higher will get you a better mortgage rate.

- Make a larger down payment. Making a bigger contribution than the minimum down payment reduces the risk of your lender, so consider making a down payment of at least 25%.

- Significantly reduce your debt. Your debt-to-income ratio, which compares your monthly debt payments to your monthly gross income, should not exceed 50% in most cases. If you’re looking to buy a fourplex, 75% of the income from that property may be factored into the income equation.

- Increase your cash reserves or assets. Cash reserves are liquid assets that you have in your accounts after covering your down payment and closing costs. Lenders usually look for a minimum of six months’ worth of mortgage payments in cash reserves for investment properties. However, it would be extra beneficial to have a year’s worth or more. Having extra cash to cushion the times when your property is in between renters will minimize the risk for you and your lender.

Mortgage Loan Terms

The loan terms of any multifamily real estate loan are deal-specific. In most cases, first-time borrowers opt-in for conventional mortgage loans, which usually have 15-year or 30-year terms. Short-term loans can be as short as 6 months or up to 3 years.

Mortgage Loan Limits

Loan limits basically mean how much you’re able to borrow as a lender. Generally, loan limits depend on multiple factors and the type of loan (which we also cover in this article down below). In most cases, loan limits depend on the area you’ve selected, the number of units in the property, the type of mortgage loan you’re applying for, and the lender you’ve chosen. Each individual lending institution or bank has their own set of loan limits.

Loan to Value Ratio

This is a metric used by lenders to measure the risk of the loan. For example, a 25% down payment with a mortgage loan that covers 75% of the property’s value has a 75:25 loan-to-value ratio. Some situations such as a zero down payment VA Loan (a 100:0 loan-to-value ratio) have more requirements due to the increased risk. Higher-risk deals may sometimes even require a higher down payment with a maximum of 65:35 loan-to-value ratio.

Different Types of Multifamily Mortgage Financing Options

1. Conventional Multifamily Mortgage Loan

The most common type of loan available to owner-occupants and real estate investors is a conventional loan. Conventional loans for multifamily properties are typically provided by mortgage lenders such as banks, credit unions, and other various financial institutions, similar to single-family properties.

Fannie Mae and Freddie Mac are the top two giants in the mortgage industry which provide liquidity, stability, and affordability to the mortgage market. The majority of conventional loans provided by lenders are “conforming loans” which conform to the underwriting guidelines or lending standards set by Fannie Mae and Freddie Mac.

Down Payment for a Multifamily Property

If you’re considering a duplex, then the minimum required is typically a 20% down payment. However, if you’re considering a triplex or a fourplex, the minimum that lenders typically require in 2022 is a 25% down payment.

An owner-occupied property may qualify for a 20% or lower down payment (as low as 3%) as long as the rental income of the property fits certain guidelines. Borrowers who qualify for a mortgage with a down payment of less than 20% are required to pay for private mortgage insurance (PMI), which is a type of insurance policy that protects the mortgage lender in case they default on their loans. PMI can cost from 0.3% to 1.5% of your loan amount annually.

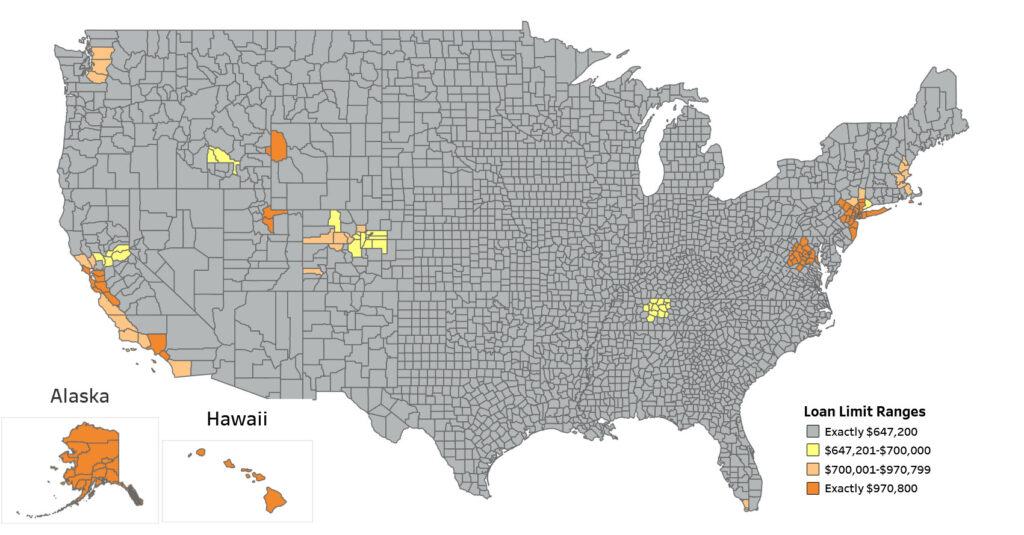

What is the maximum loan limit in 2022?

The Federal Housing Finance Agency (FHFA) recently raised the conforming loan limits for 2022. The limits vary depending on the number of units in the property and the county in which it is located.

| Low-Cost Area | Medium-Cost Area | High-Cost Area | |

| 1 Unit | $647,200 | $647,201-$970,799 | $970,800 |

| 2 Units | $828,700 | $828,701-$1,243,049 | $1,243,050 |

| 3 Units | $1,001,650 | $1,001,651-$1,502,474 | $1,502,475 |

| 4 Units | $1,244,850 | $1,244,851-$1,867,274 | $1,867,275 |

For example, the maximum amount you can borrow for a 4-unit (fourplex) property in Los Angeles County and Orange County, California is $1,867,275. You can browse an interactive version of the loan limits map on FHFA’s website.

Why a Conventional Multifamily Mortgage Loan is the Best Option for Most Investors

Conventional mortgage loans offer fixed interest rates for 15-year and 30-year terms, with the latter being the most favorable. This is the main benefit and reason why they are the best option for most real estate investors. The real estate market has its cycles in which interest rates fluctuate, so unlike adjustable-rate mortgages, your interest rate and payments for conventional mortgage loans remain consistent despite market cycles.

If you are able to qualify for a fixed-rate mortgage with a 30-year term, this is the safest route to take for any real estate investor.

Qualifying for a Multifamily Mortgage Loan

Pre-Qualified and Pre-Approved

You’ve probably heard about either of these terms when looking to buy a multifamily property. While many people use these terms interchangeably, they are two different key steps in the mortgage application process that you must understand.

The pre-qualification process is the first step that gives you an idea of how much you are most likely able to borrow. It involves a precursory review of your credit report, income, and assets.

Most first-time buyers assume that they need to speak with a real estate agent first, but in reality, the first step is to learn if you are qualified for a loan or not. Real estate agents will not be able to help you find the perfect property to buy without knowing how much you qualify for unless you’re paying with cash.

Pre-qualification is usually quick and can be done over the phone or online, and there’s usually no cost involved.

It is also important to note that pre-qualification is only based on the information that you submit to a mortgage lender or broker, so it doesn’t mean much if you don’t provide accurate information. If you want to go through a smoother loan application process, you should consider submitting information that is as accurate as possible.

The pre-approval process is the next step after being pre-qualified and takes much more involvement. In order to get pre-approved, you need to complete an official mortgage application and provide the lender with all the necessary documents for them to perform an extensive review of your credit and financial background. This entire package of documents is presented to and reviewed by a third-party underwriter. The lender will then offer a pre-approval up to a certain amount along with a better idea of the interest rate of the loan.

The entire pre-approval process usually takes a few hours to complete. Our mortgage division at Sage Real Estate typically processes loans with an automated underwriting system in 1-2 hours.

| Pre-qualification | Pre-approval | |

| Do I need to fill out a mortgage application? | No | Yes |

| Do I have to pay an application fee? | No | Depends |

| Does it require a credit history check? | No | Yes |

| Is it based on a review of my finances? | No | Yes |

| Does it require an estimate of my down payment amount? | No | Yes |

| Will the lender give me an estimate for a loan amount? | Yes | No |

| Will the lender give me a specific loan amount? | No | Yes |

| Will the lender give me interest rate information? | No | Yes |

Documents for Income Verification

If you’re employed, you’ll need your two most recent paycheck stubs, and the last two years of W-2 forms and tax returns. If you’re self-employed, you’ll need the last two years of personal and business tax returns.

Rental Income from Units

The beauty of purchasing multifamily properties is that when necessary, you have the ability to factor in projected rental income from units in the property to qualify for a loan. Lenders typically consider 75% of the total income because 25% is taken out for vacancy and maintenance factors.

If you are purchasing an owner-occupied property, the income is calculated from the rest of the tenant-occupied units. If you are purchasing an investment property, the income is calculated from all of the tenant-occupied units in the property.

For lenders to consider rental income from your multifamily property, you need to provide documents showing that the rental income is stable. Acceptable proof could be a current lease, an agreement to lease, or at least two years’ worth of consistent rent history. You may also need to provide IRS Form 1040 Schedule E to prove that the rent was reported on your tax return. You can also use the potential rental income reported when the property has been appraised.

Required Credit Score and Debt-to-Income Ratio

Your credit score impacts the interest rate that you may qualify for. The minimum credit score required is 620 and a debt-to-income ratio below 43%. In order to get the best mortgage interest rates, you’ll need a credit score that is considered “platinum” at 760 and above.

After this section on “conforming” conventional mortgage loans, there are other options for non-conforming loans. If conventional loans aren’t an option for you, a non-conforming loan may be able to help you get financing for the property you want to purchase. A non-conforming loan is basically defined by two main reasons: it doesn’t meet a requirement set by Fannie Mae and Freddie Mac, or the loan is too large to be considered a conforming loan.

2. Government-backed Multifamily Loan (FHA Loans)

If you don’t have enough cash to provide the required 20% or more down payment or have a lower than required credit score, government-backed Federal Housing Administration (FHA) loans are also an option for you. FHA loans are offered with the goal of increasing accessibility to homeownership and can be used to buy or refinance single-family homes, condominiums, and owner-occupied multifamily properties with up to four units.

Note: Even if you have excellent credit and enough money saved for at least a 20% down payment, don’t just go for an FHA loan because they can sometimes be more costly than a conventional mortgage loan.

FHA Loan vs. Conventional Loan

| FHA Loan | Conventional Loan |

|---|---|

| Lower credit score to qualify | Stricter lending requirements |

| Mortgage insurance mandatory | Mortgage insurance required if down payment is less than 20% |

| Down payment of at least 3.5% | Down payment range 3% to 20% |

| Loans backed by the government | Loans not backed by the government |

| Can only be used to finance a primary residence | Can finance a primary residence, vacation home, rental property, etc. |

Benefits and Requirements of an FHA Loan

FHA loans are federally insured and issued by FHA-approved banks and mortgage lenders. The FHA guarantees a portion of loans, offering protection for the lender in case of a default. Thanks to that guarantee, lenders are willing to offer more favorable terms, require lower credit scores, and accept lower down payments.

With an FHA loan, you can pay as low as 3.5% down payment with a credit score of 580 or above. Credit scores between 500 to 570 can still qualify for as low as a 10% down payment.

Just like applying for a conventional loan, lenders will ask you to provide the two most recent pay stubs, W-2 forms, tax returns, and other financial asset documentation. You may also use the potential rental income from the other tenant-occupied units to help you qualify. The FHA guideline’s maximum debt-to-income ratio is 43%, but exceptions are possible with strong credit scores or extra cash reserves.

Mortgage insurance is built into every FHA loan. There are two premiums that must be paid: The first is an up-front payment, which can be rolled into the loan and paid throughout its life. The second is a monthly premium. Borrowers who can put down 10% or more pay these premiums for 11 years. Anyone who makes a down payment of less than 10% must make these premium payments for the duration of their mortgage.

In order to be approved for an FHA loan, you are required to have an FHA appraisal on the property. FHA appraisal guidelines tend to be more stringent than conventional loans. You must also live in your property as an owner-occupant for at least a year if you decide to take out an FHA loan.

If you are thinking about purchasing a fourplex property, you might be subject to the FHA Self-Sufficiency Test. Learn more about it in this other article.

Now that we’ve covered conventional and FHA loans, there are also other available options to finance multifamily properties if you do not qualify for either of the two options above.

3. USDA Loans for Multifamily Properties in Rural Areas

U.S. Department of Agriculture (USDA) Loans only apply to rural areas and towns with 35,000 or fewer residents along with federally recognized tribal lands. The primary objective of this program is for the construction, improvement, and purchase of multifamily rental housing for low to moderate-income families and individuals.

While the program offers guarantees of up to 90% of the loan amount, loans are still serviced through private mortgage lenders. Because they are intended for a primary residence, you cannot use a USDA loan for investment property; only for an owner-occupied property with at least 5 units.

For-profit entities may borrow up to 90% and non-profit entities may borrow up to 97% of the total development cost or appraised value, whichever is less.

Rent for individual units is capped at 30% of 115% area median income (AMI), and the average rent for the entire multifamily property (including tenant-paid utilities) cannot exceed 30% of 100% of area median income, adjusted for family size.

4. Paying Zero Money Down with VA Loan

The U.S. Department of Veterans Affairs (VA) helps active-duty service members, Veterans with discharges other than dishonorable, and eligible surviving spouses become homeowners. This also includes owner-occupied multifamily properties with up to 4 units. VA Home Loans are provided by private lenders, such as banks and mortgage companies. The VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms.

Main Benefits of a VA Loan

- Zero or no down payment required as long as the sales price is at or below the property’s appraised value.

- No loan limit with full entitlement if you can afford the loan, VA will back loans in all areas of the country, regardless of home price.

- Competitively low interest rates from private banks, mortgage lenders, or credit unions.

- Limited closing costs, which may be paid by the seller, lender, or any other party.

- No Private Mortgage Insurance (PMI) or Mortgage Insurance Premium (MIP) required.

- Lifetime benefit: you can use it multiple times.

- No penalty fee for paying off the loan early.

VA loans also have a funding fee. Generally, these fees range from 1.25% to 3.3% of the total loan amount. However, you don’t have to pay it at closing since the VA allows it to be included in the loan. Some veterans may also qualify for a waiver if they receive VA disability compensation or meet other criteria.

Requirements and Eligibility for a VA Loan

The VA is the only organization that can determine eligibility for VA home loans. You’ll need a valid Certificate of Eligibility (COE), which you can also obtain online. Once you’re able to receive your COE, you can begin working with your preferred mortgage lender.

Each mortgage lender has different requirements: minimum credit score, income, and any other requirements to approve a loan. VA does NOT require a minimum credit score, but most lenders will use a credit score to help determine your interest rate and to lower risk. Typically, lenders may want borrowers to have a minimum credit score.

Download our Sage Real Estate mortgage division’s VA Home Loan Guide here.

5. Non-Qualified Mortgage Loans for Multifamily Properties

A non-qualified mortgage is a loan is designed for buyers who cannot meet the strict criteria of a qualifying mortgage.

This type of loan is ideal for borrowers who have fluctuating incomes or who are self-employed.

The type of borrower who might benefit from a non-qualified mortgage loan includes:

- Retiree

- Self-employed

- Real estate investor

- Business owner

- Foreign national

- Buyer who lives off investments, or has high assets and low income

- Buyer with a high debt-to-income ratio

- Buyer with less-than-perfect credit

Generally, lending guidelines for this type of loan dictate that the lender must analyze the borrower’s Ability to Repay (ATR) through various terms such as reviewing the cash flow of personal and business bank accounts. Non-QM loans are typically for borrowers with unique income qualifying circumstances, along with possible credit issues such as bankruptcy, foreclosure, late payments, or other isolated credit issues.

The two key differences between qualified and non-qualified mortgage loans:

- Non-qualified mortgage loans utilize an alternative methods of income verification.

- Non-qualified mortgage loans are not insured, guaranteed, or backed by FHA, VA, Fannie Mae, or Freddie Mac.

While a non-qualified mortgage is as safe as other qualified mortgages, it is extremely important to speak with a professional mortgage broker to determine whether a non-qualified mortgage loan is the right choice for you.

6. Bridge Loan vs. Hard Money Loan

Not all bridge loans are hard money loans. But all hard money loans are bridge loans, technically. The easier and faster the loan is to obtain, the more likely it’s considered a hard money loan. Hard money lenders are private lenders that tend to provide loans on a short-term basis and accept property or assets as collateral. It is usually a means of last resort, and therefore, typically carries the highest interest rates (9% or higher).

A bridge loan is a short-term financing option used to “bridge” the gap while in the process of securing a more permanent long-term loan. These loans typically have higher interest rates and are for terms ranging from 18 months to two years, often with an option to extend for one to two more years.

The lender typically considers a loan based on the location, type, and condition of the property, along with the amount of down payment issued by the borrower on a case-by-case basis. Borrowers should only consider using a hard money lender if they have a solid execution and/or exit strategy that will allow them to repay the loan in a short amount of time.

7. Private Party Loan

A private party loan is simply a loan obtained by a borrower from a private individual lender such as a friend or family. If done right, tapping the “Bank of Family and Friends” can be financially lucrative for both you and the person lending you the money.

The loan itself works like a regular mortgage – you must pay back the loan, plus interest, within a certain, agreed-upon time. Private loans typically require you to pay your loan off in less time than a traditional mortgage loan.

It’s important to remember that any loan is a business transaction. That means once you accept a loan from a friend or family member, they also become your lender, with a lien on your home. If you fall behind on payments or disagree with the way they are handling the loan, the relationship could deteriorate quickly. A default on this type of loan could even end up in court or with your family member or friend seizing your property.

8. Seller Carry-back Note or Seller-Carried Note

Similar to a private party loan, a seller carry-back note or seller-carried note is a type of financing in which the seller of the property acts as the lender and provides a loan to the buyer. It may also be referred to as owner financing or seller financing. Payments on seller carry-back notes only include interest, and don’t require PMI or MIP.

This method is also one legal way for sellers to avoid paying taxes on the sale of their property if the seller does not want to initiate a 1031 tax-deferred exchange. Seasoned real estate investors and sellers find this method favorable when they want passive income without the headache of managing multifamily properties.

Other Frequently Asked Questions on Multifamily Financing

How many mortgage loans can an individual have?

Every mortgage lender has its own exposure limit which your mortgage broker can help you determine. However, in terms of investment properties outside of your primary residence, most lenders may limit you to 6 to 7 mortgage loans while some may allow up to 10 mortgage loans. In other words, you may have up to 10 properties that are financed.

Is it a good time to refinance my property in 2022?

If you’re already a multifamily property owner and fit any of these criteria below:

- You acquired your mortgage loan a few years ago

- You haven’t refinanced in the past

- You have more equity on your property than when you obtained your loan

- The interest rates today are lower than the fixed interest rate of your mortgage

- You’re willing to hold on to your property for many more years

Again, as mentioned above, despite rising interest rates in 2022 we are still experiencing historically-low interest rates compared to previous decades. So if you fit any or most of the criteria above and you can lock in a lower interest rate, it’s a no-brainer decision to refinance your property this year especially if you want to maximize your Return on Equity.

Make sure to talk to a professional mortgage broker to determine whether this is the right choice for you.

Qualifying for a Mortgage with Income from Stocks or Cryptocurrency

If you’re an investor who is lucky to have reached the moon and received a substantial amount of income or capital gains from either stock market investing or cryptocurrency and you’re able to legally prove this income, then you can still finance a multifamily property.

Even if you do not qualify for conventional or qualified mortgage loans either because of your credit score or lack of consistent income, you may still be able to obtain a non-qualified mortgage loan with your assets and investment income.

Conclusion

Now that you’ve read through the most elaborate guide to financing a multifamily property (duplex, triplex, or fourplex) in 2022, it’s time to put in the work and talk to a mortgage broker or lender.

It is important to also remember that in real estate every deal is a good deal because multifamily properties almost always appreciate in value year over year, especially here in California.

While financing options each differ on a case-by-case basis, it is always important to work with a professional mortgage broker to understand which options work best for you and the property you’re looking to buy.

If you’re looking to finance multifamily properties in California or purchase multifamily properties in Long Beach, California, feel free to contact our team at Sage Real Estate.