If you’re a real estate investor or apartment owner in Long Beach, California then you need to read our comprehensive market analysis of the Long Beach multifamily real estate market and 2022 projections!

Is Long Beach Still a Good Place to Invest?

The real estate market in Long Beach, California has always presented real estate investors with a hotbed of attractive investment opportunities. Not only does the city confidently boasts of high demand from both residential and commercial tenants, but its multifamily real estate sector also continues to experience healthy growth despite the global COVID-19 Coronavirus pandemic.

Known for its local diverse culture and abundance of activities, Long Beach also remains one of the most attractive and fastest-growth cities in California with SpaceX moving its operations into the city, North Long Beach experiencing unprecedented growth, while still being one of the last affordable coastal cities in Southern California.

Regardless of other factors, there are a few solid metrics that seasoned real estate investors use to determine whether any area is a great place to invest or not:

Long Beach Population Growth

Between the census of 2010 and 2020, the city’s population grew from 462,257 to 466,742. However, despite California losing over 211,313 residents in 2020, the city of Long Beach grew an estimated 0.02% in 2021 alone. This is a great indicator that the population is still thriving and there will still be consumer demand in the long-term future.

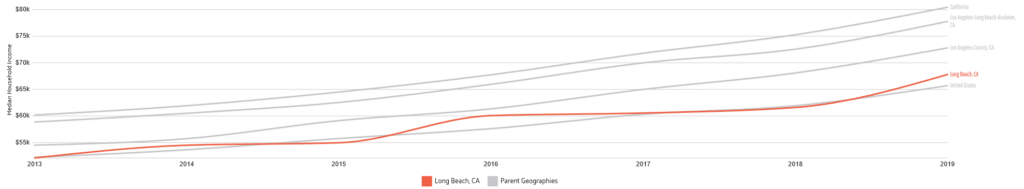

Long Beach Household Median Income Growth

According to Data USA in 2019, the median household income in Long Beach was $67,804 with a 10.1% growth from the previous year. Real estate investors, apartment owners, and landlords can expect more rental demand as the combination of strong economic growth and a significant increase of high-profile employers moving into Long Beach continues throughout the short term.

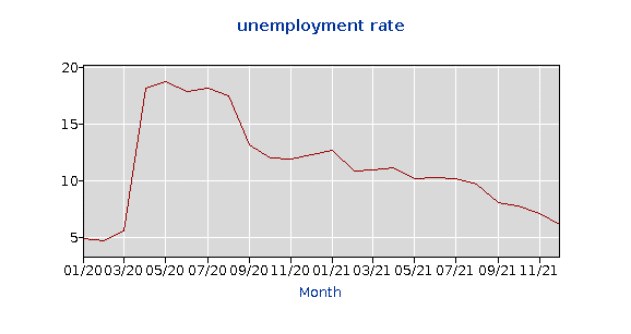

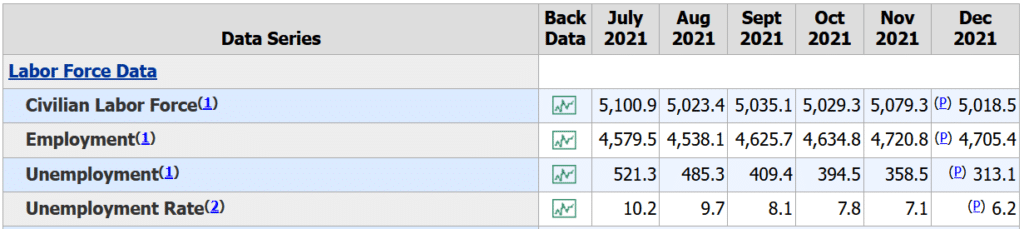

Long Beach Unemployment Rate

The city of Long Beach is grouped alongside other cities in what’s known as the Los Angeles-Long Beach-Glendlace Metropolitan Region. This region has been experiencing a steady decline in unemployment since the beginning of the global COVID-19 pandemic, with the lowest being recorded at 6.2% in December of 2021 compared to 14% in 2020. For landlords, this is a great indicator because it shows that the local economy is recovering and tenants are more likely to consistently pay rent on time.

Long Beach Vacancy Rates

Multifamily properties in Long Beach continue to experience the highest demand in decades. The occupancy rates for apartments in the city were at 97.1% as of the third quarter of 2021, the highest in 11 years of research provided by Newmark Group Inc.

From the anecdotal perspective of our landlord clients at Sage Real Estate, nobody is worried about finding tenants in this market as the demand is crazy. As soon as a rental listing goes live, landlords receive at least a hundred inquiries within the first 24 hours. Although the housing supply has struggled to keep up with the strong demand, experts are estimating that the California housing crisis will still last for decades.

Long Beach Apartment Rental Rates

In 2021, the apartment rental rates in Long Beach increased by 6%, which is at the normal expected rate since the maximum allowable rent increase in Long Beach is up to 6.8% until April of 2022. If you’re in the business of owning apartment rental units, this is a positive indicator because the value of your property increases proportionally with your rental rates.

Crime Rate in Long Beach, CA

According to the Long Beach Police Department’s recent announcement, violent crime in the city has decreased by 75% between 1991 and 2021. “While most major cities in our country experienced an increase in murders compared to 2020, the murder rate in Long Beach did not increase,” said Chief of Police Wally Hebeish. For real estate investors looking to invest into Long Beach, this is also another positive indicator.

Fourplex Market Statistics in Long Beach, CA

Number of Fourplex Sales:

- 2020: 82 fourplexes sold

- 2021: 118 fourplexes sold (43.9% increase)

Sage Advice: On average 100 fourplexes are sold every year in Long Beach. Despite the lack of inventory and the pandemic, fourplexes in Long Beach still continue to sell and the market is healthy. Great news for both apartment owners and those looking to purchase a property.

Average Days on Market

- 2020: 44 days

- 2021: 44 days

Sage Advice: The average time it takes to sell a fourplex is still 44 days. Despite a higher demand and number of sales, an average of 44 days on market is still a good indicator for apartment owners thinking about selling their property.

Average Fourplex Inventory

- 2020: 38 fourplexes

- 2021: 24 fourplexes (37% decrease)

Sage Advice: In 2021, real estate investors had 37% fewer options to choose from with an average of 24 fourplexes on the market at any given time. We’ve been seeing a year-over-year decrease in inventory since our team started tracking these numbers. If you’re a buyer, this means there will be more competition and a lesser likelihood of getting the property you want. Less available inventory is an advantage for apartment owners selling their property due to higher competition trying to outbid each other.

We are expecting the inventory of fourplexes in 2021 to remain low throughout the year, which is going to play a major role in the appreciation of property values.

Average Fourplex Sales Price

- 2020: $1,196,079

- 2021: $1,342,000 (12.2% appreciation)

Sage Advice: In 2021, we saw a significant increase in the average fourplex sales price by 12.2% which is not surprising. Our team of analysts has been seeing this type of double-digit increase for the past 5 years. We believe property values are going to keep rising in 2021 but most likely at a slower rate than in previous years. There are no indicators of massive foreclosures or price decreases any time in the near future.

Long Beach Apartment Market Statistics (5 to 20 Units)

- Number of Sales: 208 transactions

- Average Cap Rate: 4.4%

- Average Price per Unit: $273,560

- Average Time on Market: 3.8 months

Sage Advice: We still expect high investor demand for apartment buildings within this range despite the lack of inventory in the market. This is still a seller’s market in 2021, so apartment owners are still at a huge advantage of getting their dream sale price.

Primary Concerns of Real Estate Investors

How Increasing Interest Rates Can Affect the Multifamily Real Estate Market in Long Beach, CA

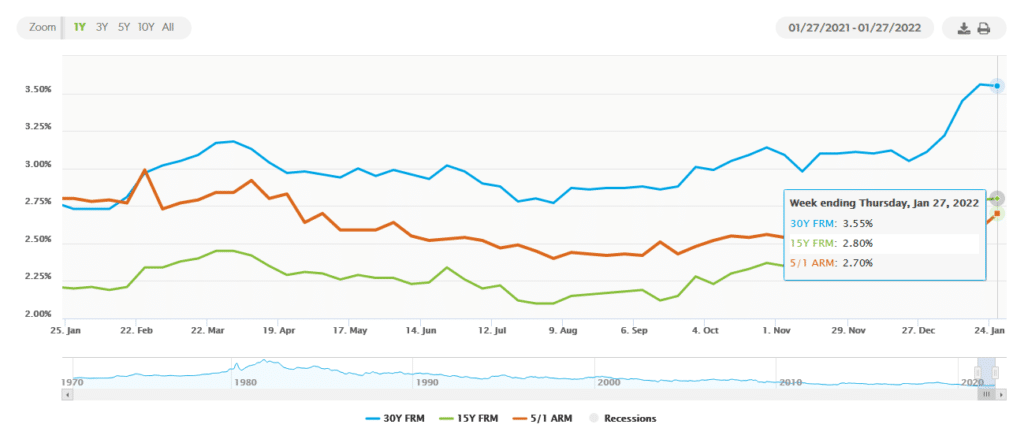

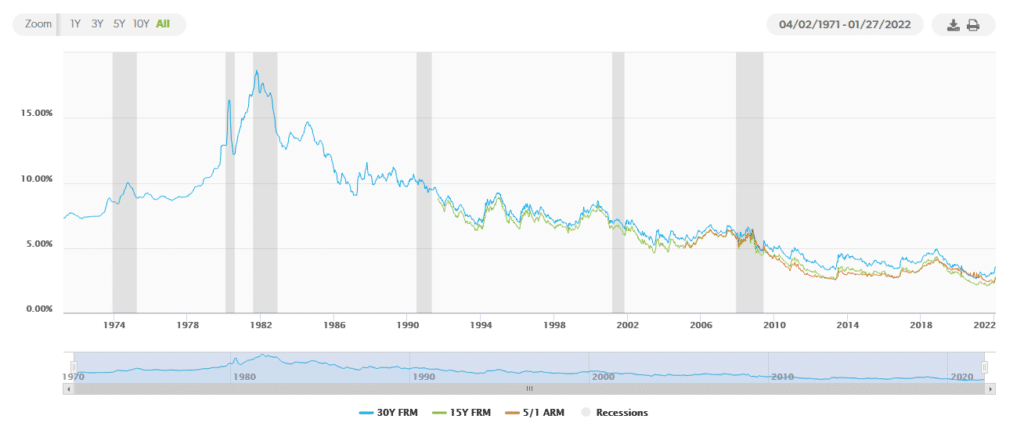

Mortgage interest rates remained relatively stable throughout 2021 and attracted many real estate investors to jump into apartment and home ownership. However, as the US economy continues its strong recovery into 2022, the Federal Reserve has begun increasing interest rates earlier than expected.

Towards the end of 2021, mortgage interest rates were at 3.11%. As of writing this article on February 1st of 2022, the current going rate is at 3.55% for 30-year mortgage loans according to Freddie Mac.

According to numerous financial analysts and economic experts are forecasting interest rates to go as high as 4%. We still recommend that buyers take advantage of these low interest rates as soon as possible before they increase again. However, real estate investors and potential new homeowners should not worry as 4% is still considered historically low.

Sage Advice: Many apartment owners and investors we speak with every day are worried that the steady increase of interest rates will affect multifamily property values in a negative way. In essence, this is highly unlikely to happen. We can expect a potential slow down in property sales, but investor demand is still as strong as ever so the momentum of growth in the market will continue into 2022.

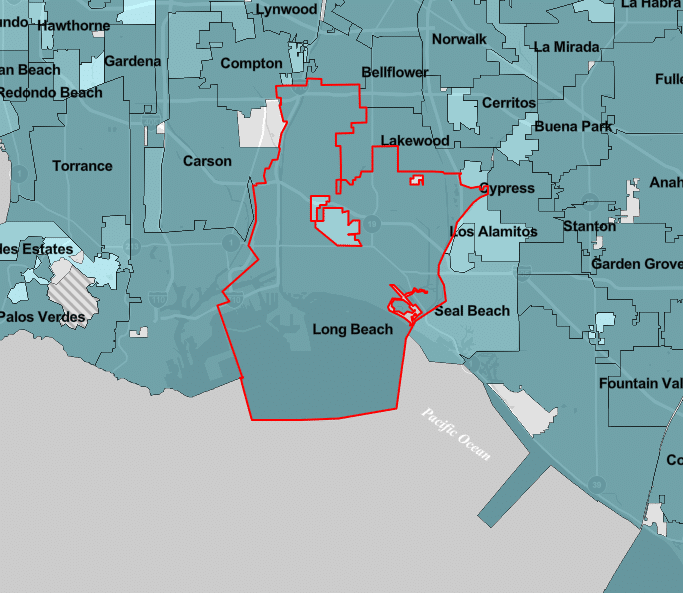

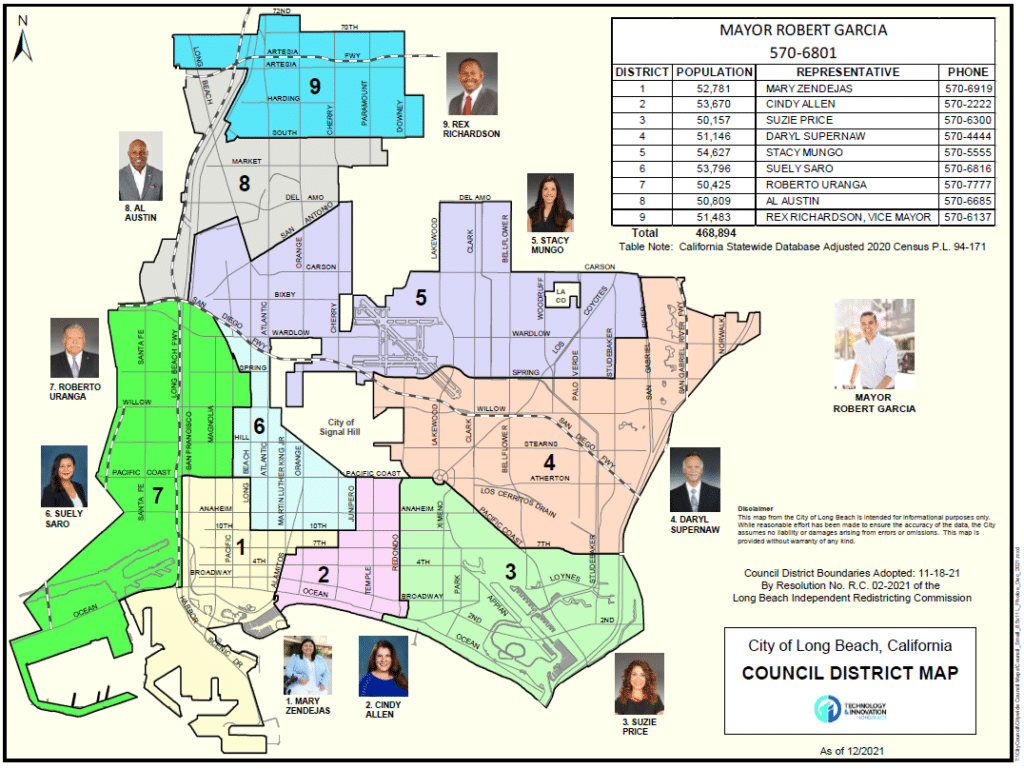

City of Long Beach Redistricting Effect on Property Values

Due to an increase in population for certain areas, the City of Long Beach revised its district map at the end of 2021. A significant number of apartment owners and landlords we work with have voiced out their concerns about whether a change in districts will affect their property’s value.

Sage Advice: District changes only affect which city council member represents your area. It does not have any effect on property values.

Final Thoughts and Conclusion

Is 2022 still a good year for investors in Long Beach? Absolutely! We know that California’s housing crisis will continue for decades to come as the housing supply tries to catch up to the demand.

As housing demand, population growth, household income, and rental rates continue to increase year-over-year, so will property value appreciation. It doesn’t matter if you’re worried about buying at the top of the market because you’re buying into an appreciating real estate business that will never run out of demand.

For real estate investors who want to buy a property: The California Housing Crisis will not be simply solved in 10, 20, or even 30 years. So when you invest in real estate, you’re investing in a scarce business that has demand right now and well into the future. This demand is what drives a property’s appreciation and allows real estate investors to build wealth, financial freedom, and eventually retire some day.

If you’re still waiting until prices go down, you’re going to be waiting for a very long time. You need to capitalize on the low mortgage interest rates, which counts as your Cost of Capital. The longer you wait, the longer you’re preventing yourself from getting in the game and building wealth through real estate.

- Schedule a FREE Investor Consultation with Juan Huizar today.

- Begin your search for investment properties in Long Beach, CA.

If you’re an apartment owner and you’ve been thinking of selling after building massive equity for 1 to 2 decades: This is a wonderful time to sell because you have the advantage in a seller’s market. Your property has never been worth more than ever before. More properties are selling than ever before, and there is less competition. The numbers are telling us that this is the perfect time to put your property on the market. Especially with the possible elimination of Section 1031 Exchanges, now is potentially a good time to sell your property. Call us today for a FREE Property Valuation.