Whether you’re a seasoned investor or new to real estate, this guide will help you understand what cap rates are, why they’re important, and how to calculate them.

In the world of real estate investing, there’s a term you’ll often hear tossed around: “cap rate,” short for capitalization rate. While it might sound complicated at first, the concept is straightforward, and mastering it can be immensely beneficial for anyone looking to invest in income-producing properties. In this blog post, we’ll break down what a cap rate is, why it’s essential, and how you can calculate it. By the end, you’ll be equipped with the knowledge to evaluate properties like a pro.

What is a Cap Rate?

The capitalization rate, or cap rate, is a metric used by real estate investors to determine the potential return on investment (ROI) for an income-producing property. In simple terms, the cap rate represents the rate of return an investor can expect to receive based on the property’s net operating income (NOI) and its current market value. It’s a crucial tool for comparing different investment opportunities and making informed decisions.

Cap rates are commonly discussed in the context of multi-unit buildings, such as apartment complexes or commercial properties. Investors will often ask, “What’s the cap rate?” when evaluating a property because it provides a quick snapshot of its profitability. However, while cap rates are useful, they are not the be-all and end-all of investment metrics. As we’ll explore, several other factors come into play when assessing a property’s value.

The Three Key Components of Cap Rate

To fully understand cap rates, you need to be familiar with three critical components: Net Operating Income (NOI), Property Value, and the Cap Rate itself.

Net Operating Income (NOI): This is the income generated by the property after deducting all operational expenses but before deducting any mortgage payments or taxes. Operational expenses typically include maintenance costs, insurance, property management fees, and utilities. For example, if you own an eight-unit apartment building, your NOI would be the total income generated from rents minus all the costs associated with running the property.

Property Value: This is the market value of the property, or what it could sell for under current market conditions.

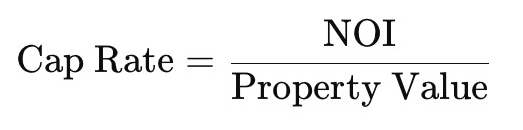

Cap Rate: The cap rate is calculated using the following formula:Cap Rate=NOIProperty ValueCap Rate=Property ValueNOI

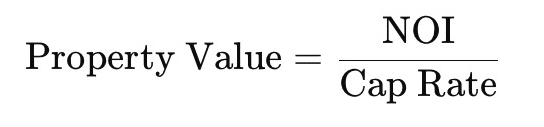

Alternatively, if you know the desired cap rate and the NOI, you can rearrange the formula to determine the property’s value:

How to Calculate Cap Rate

Calculating the cap rate is a straightforward process once you have the necessary information. Here’s a step-by-step guide:

Determine the Gross Income: Calculate the total income the property generates over a year. This includes all rent payments and any additional income, such as from laundry facilities or parking fees.

Deduct Operational Expenses: Subtract all operational expenses from the gross income to arrive at the Net Operating Income (NOI). Remember, operational expenses do not include mortgage payments or capital expenditures like major renovations.

Calculate the Cap Rate: Divide the NOI by the current market value of the property. The result is the cap rate, expressed as a percentage.For example, if an eight-unit building generates $139,200 annually in gross income and has operational expenses of 35%, the NOI would be $90,480. If the property is valued at $1.8 million, the cap rate would be:

The Inverse Relationship Between Cap Rate and Property Value

One of the most critical aspects to understand about cap rates is their inverse relationship with property values. As cap rates increase, property values tend to decrease, and vice versa. This is because a higher cap rate indicates a higher risk or a desire for a higher return, which usually translates into a lower property price. Conversely, a lower cap rate suggests that the property is in a desirable location with lower perceived risk, which drives up the price.

For instance, in a competitive market like Southern California, a cap rate of 5% might be common for properties in prime locations. However, if cap rates begin to rise, indicating an increase in market risk or a shift in investor expectations, property values may start to decline. A property that was once valued at $1.8 million at a 5% cap rate might only be worth $1.65 million at a 5.5% cap rate.

When to Use Cap Rates

Cap rates are particularly useful for evaluating income-producing properties like apartment complexes, office buildings, and retail centers. However, they are less applicable for single-family homes, condos, or small multi-family properties (like duplexes or triplexes) that may not be primarily investment properties. In these cases, market conditions, property location, and buyer preferences often play a more significant role in determining value.

Limitations of Cap Rates

While cap rates are an essential tool, they do have limitations. One significant limitation is that they only provide a 12-month snapshot of a property’s performance. They do not account for future changes in income or expenses, nor do they consider factors like property appreciation or depreciation. Additionally, cap rates rely on accurate data, which means investors must trust that the seller’s reported NOI and expenses are correct.

Conclusion

Understanding cap rates is a vital skill for any real estate investor. By mastering this metric, you can make more informed decisions, compare investment opportunities, and better understand the relationship between property value and expected returns. However, remember that the cap rate is just one of many metrics to consider. Always take a holistic approach to property evaluation, considering factors like location, market trends, and your long-term investment goals. With this knowledge, you’ll be well-equipped to navigate the complexities of real estate investing and make smart, profitable decisions.