The newly signed historic Infrastructure Bill, also known as the Infrastructure Investment and Jobs Act, was a much-needed $1.2 trillion investment towards infrastructure maintenance and upgrades across the country. However, the million-dollar question for real estate investors, homeowners, and real estate professionals is “how will the infrastructure bill impact the real estate industry?” The short answer: it will affect real estate in a significantly positive manner.

Ultimately, this infrastructure bill is a win for America as funds have been allocated for every kind of infrastructure upgrade that has been pending since the last major infrastructure upgrade with the Federal Aid Highway Act of 1956, which built America’s highways.

Infrastructure Bill Breakdown

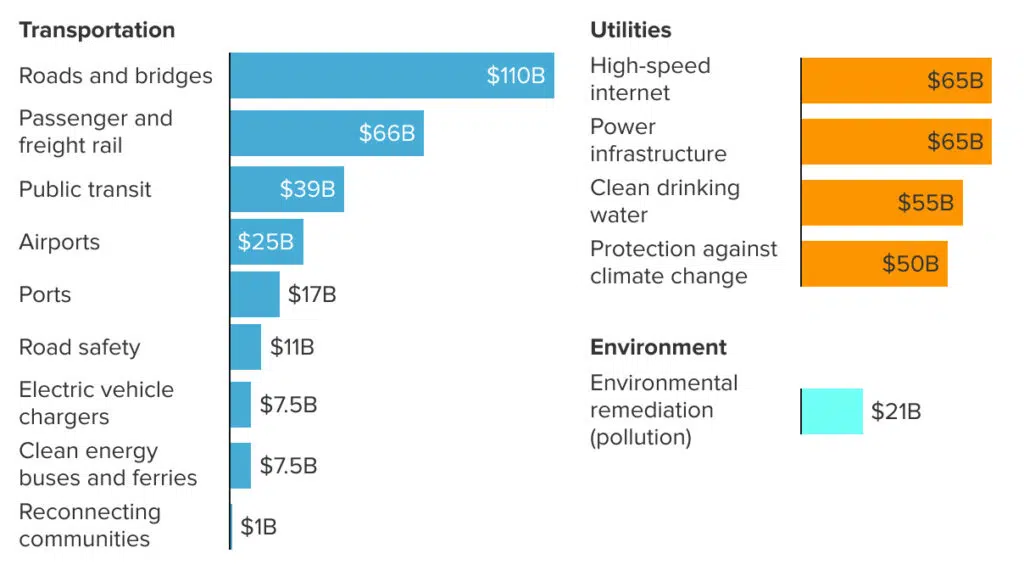

The 2,702-page Infrastructure Bill includes just $550 billion in new spending. When we include additional funding normally allocated each year for highways and other infrastructure projects, the total adds up to $1.2 trillion. The new spending includes:

- $110 billion to repair and rebuild roads and bridges with a focus on climate change mitigation.

- $55 billion to deliver clean water to all American families and eliminate the nation’s lead service lines.

- $65 billion to ensure every American has access to reliable high-speed internet.

- $39 billion to improve public transportation options for millions of Americans and reduce greenhouse emissions.

- $66 billion to invest into passenger and freight rail for a better transportation and economic future.

- $25 billion to upgrade airports and $17 billion to strengthen ports for a better supply chain without disruptions that cause inflation.

- $17 billion to build a national network of electric vehicle (EV) chargers.

- $65 billion to upgrade our power infrastructure to deliver clean, reliable energy across the country.

- $50 billion to make our infrastructure resilient against the impacts of climate change, cyber-attacks, and extreme weather events.

- $21 billion to deliver the largest investment in tackling legacy pollution in American history.

- $11 billion to address road safety.

Bird’s-Eye View of How the Infrastructure Bill Will Indirectly Impact the Real Estate Industry as a Whole

Although nothing in the bill directly addresses benefits to the real estate industry or real estate investors, the results of the $1.2 trillion dollar investment into America’s infrastructure have a multitude of benefits for every aspect of the real estate industry.

One of the key factors that affect the real estate industry is the overall health economy, which is generally measured by economic indicators such as job growth, the strength of our supply chain, construction spending, home sales, and consumer spending. In order to have a healthy and growing economy, it’s crucial to have a robust infrastructure that serves as foundational support.

Unfortunately, America’s infrastructure is so outdated and subpar compared to other countries that the economical effects of the almost two-year-long COVID-19 pandemic are still reverberating because of supply chain issues and inflation caused by our poor infrastructure. In fact, the American Society of Civil Engineers recently rated America’s infrastructure with a scorecard of “C-“.

Improved Economy Because of Job Growth

One of the main goals of the new infrastructure bill is to stimulate massive job growth to bolster our economy – that’s why it was called the Infrastructure Investment and Jobs Act. In real estate, unemployment and job growth directly influence all aspects of residential, multifamily, and commercial real estate.

An increase of jobs means that:

- More people are able to afford to rent an apartment, which benefits landlords and multifamily apartment owners.

- More people are able to buy a house, which benefits the residential real estate market with more home sales

- An increased demand in office space, commercial space, and industrial space leads to less vacancies and an overall positive impact for commercial real estate.

- Residential and multifamily property values will appreciate as a result of population growth caused by job growth.

Real estate investing as a way to build wealth becomes more desirable with job and income growth. People may want to invest in the real estate market to purchase their own home and to end the endless cycle of having to pay monthly rent. However, when there is no job or income growth unemployed individuals are unable to buy because they have no income to either be able to afford a property or take a loan to buy one.

Layoffs or the fear of potential job losses can cause home sales to decline in many areas and can force homeowners into foreclosure, boosting property inventory levels and placing downward pressure on home prices. On the flip side, strong job growth can signal steady demand for home purchases as potential home buyers gain confidence and the equity required to buy a home.

Upgrading Freight Rail, Ports and Airports to Strengthen Supply Chains

Decades of neglect and under-investment in our infrastructure have left the links in our supply chains struggling to contribute to economic recovery from the pandemic. For almost two years, our ports across the nation have been experiencing a backlog of delays and overflow of cargo ships waiting to unload their containers. A $108 billion dollar investment into the nation’s airports, freight rails, and ports will ensure that America’s supply chains can efficiently and effectively deliver goods and services across the nation, which will directly affect state and local economies in a positive manner.

As mentioned above, better national, state and local economies promote population and job growth – which in turn significantly impacts real estate markets. A strong supply chain also promotes confidence in the economy and leads to more consumer spending and property sales. The supply of money in an economy is critical to its overall health, especially housing market health. If money’s too difficult to borrow, housing starts and home sales can dry up. If money’s too easy to acquire, too many buyers enter the housing market, driving up prices for a while until the inevitable market correction or even crash occurs.

Impact of High-Speed Internet on Home Values and Demand

In the digital world, access to the Internet is almost always necessary for everyday life. Remote work is widespread, communication is almost entirely internet-based, and students do most of their homework on a computer.

It’s hard to imagine a lack of internet availability in some areas of the United States, but that’s still a real problem. According to a report by the Federal Communications Commission, there are about 19 million Americans (a whopping 6% of the population) that still don’t have access to high-speed internet, most of whom live in rural areas of the nation.

The expansion of high-speed internet into these rural areas could promote upward pressure on home values. The massive exodus of skilled workers from metropolitan areas into rural areas caused by the increase of remote work during the pandemic has also increased the demand for high-speed internet in these areas. A recent study from the National Association of Realtors also found that homes without high-speed internet access are likely to receive fewer offers.

In the multifamily real estate sector, the increased availability of high-speed internet in underserved areas may also positively impact apartment vacancies by increasing the demand for rental properties in those areas, which ultimately benefits real estate investors and landlords.

Electric Vehicle (EV) Charging Stations Will Electrify Commercial and Residential Real Estate

During the pandemic, demand for electric vehicles (EVs) experienced a meteoric rise and over 18 million electric vehicles are expected to hit the road within the next 10 years. While America currently has 1.6 million electric vehicles, there are not enough EV charging stations to keep up with the demand. The Department of Energy reports that there are only 40,000 public stations registered nationwide, which is only a fraction compared to the approximate number of 150,000 gas stations nationwide.

Why is the $17 billion-dollar investment towards EV charging stations important for commercial real estate? It’s because charging stations also deliver customers to retail locations while they charge their vehicles. Drivers waiting to recharge their vehicles become captive audiences and on-location customers, which is what brick-and-mortar shopping centers have been struggling to attract throughout the pandemic.

In the short term, installing EV charging stations on commercial properties has already increased property value for owners by providing additional revenue streams and attracting high-earning tenants, clients, and visitors to their commercial areas. As an extra-added bonus: potential EV charging station investors are given incentives and tax rebate opportunities.

In addition to the hidden benefits towards commercial real estate, homeowners and apartment owners stand to benefit from it as well. According to a report by real estate advising company RCLCO, the EV wave has already hit some markets, and properties that do not offer charging stations risk losing tenants, buyers, and potential income streams. The luxury real estate market in Southern California is beginning to experience a demand for private charging stations as a new luxury amenity that increases the value of properties.

Infrastructure Upgrades Attract Investment and Appreciation

Robert Pinnegar, president & CEO of the National Apartment Association, commented that infrastructure and housing are intrinsically linked. In a statement, he said that “by building back our nation’s critical services, the apartment industry can operate more efficiently and we can help ensure that Americans have easier access to the types of housing in the place they want to live.”

Infrastructure Resilience Against the Impacts of Climate Change Will Preserve Properties

Millions of Americans feel the effects of climate change each year when their roads wash out, power goes down, wildfires spread throughout communities, or certain areas get flooded. As previously stated above, $50 billion goes directly to investing in infrastructure and tools meant to directly protect people and properties in areas in significant danger from new and ongoing climate threats.

An unpredictable and changing climate is one of the biggest threats to property values nationwide. Rising oceans threaten to make thousands of miles of coastland virtually uninhabitable for residents. Wildfires in the Western Pacific Region burn structures without discrimination. Floods force structural retrofits and cause renters and home buyers alike to seriously rethink their interest in occupying properties in seriously affected areas. This is also bad news for investors who are holding properties in areas that were previously popular spots and are now headed toward uncertain futures. The $50 billion investment is probably just a tiny fraction of the necessary funds to adequately fight the impacts of climate change on properties, but it’s a good start and is extremely good news for real estate investors.

Increased Neighborhood Desirability and More Opportunities for Real Estate Investors

Although the infrastructure bill doesn’t seem to really have much for investors, that couldn’t be further from the truth. According to Juan Huizar, a local Long Beach investor and President of Sage Real Estate, any real estate developer or investor looking to invest in a certain area typically considers five metrics to determine whether it’s suitable for a profitable investment:

- Income Growth

- Job Growth

- Population Growth

- Crime Statistics

- Real Estate Value Appreciation

We expect the infrastructure bill to support communities in dire need of infrastructure upgrades, and open access between metropolitan and rural areas by building and maintaining roads and bridges. In the long-term, everyone from renters, homeowners, developers, and investors stands to benefit immensely.

Many undesirable neighborhoods that continue to struggle with busted roads, ancient power lines, and outdated water pipes are going to get a great deal of much-needed attention. Shiny new roads, visually appealing buildings, high-speed internet, and early warning systems against natural disasters all go a long way to improving life in both metropolitan and rural communities.

After some time, the people who live there will gradually experience an increase in their living standards, which means that they may decide to take a second look at the properties in these areas. Suddenly, that undesirable neighborhood gathers more attention and interest. Real estate investors may see a spike in rentals and property valuations, and homeowners may see great appreciation in their home values.

Ultimately, the government’s initial investment into a community’s infrastructure creates a domino effect that should motivate developers and real estate investors to also invest in the community because of its significant effect on the five metrics mentioned above. Since the government is investing in communities nationwide, this opens the door to many more investment opportunities for real estate investors.

The Only Possible Forseeable Negative Effect of the Infrastructure Bill

Since around 2018, many real estate developers and homeowners have been experiencing delays and increased costs of construction and home renovations due to labor shortages of professionals available to complete projects. This problem was further exacerbated by a supply shortage and skyrocketing prices of necessary materials as a result of the COVID-19 pandemic.

Today, domestic sawmills still haven’t kept up with construction demand, and the housing industry still has to import a significant amount of its lumber from Canada. While Lumber prices have experienced an increase of roughly 400% since the start of the 2020 recession and it doesn’t appear like the infrastructure bill will make this situation any better.

The infrastructure bill “will place a huge demand for steel and concrete that will impede our ability to build out multifamily and other types of housing,” said NAHB CEO Jerry Howard. “You’ve got to increase output. And where that’s going to come from? Lord only knows. It’ll be difficult to enact because of the lack of supplies, labor, everything.”

“There’s already a labor shortage in construction so you can’t throw a $1.2 trillion-dollar nuclear bomb of money into the industry,” said Bassem Hamdy, chief executive officer of Briq, a company that runs cost estimates for construction firms.

At the end of the day, this is all speculation and it’s yet too early to expect any real results from the infrastructure bill in the short term.